TRX

Tron price

$0.27302

+$0.0019600

(+0.72%)

Price change for the last 24 hours

How are you feeling about TRX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Tron market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$25.85B

Circulating supply

94,813,102,891 TRX

99.99% of

94,813,496,053 TRX

Market cap ranking

--

Audits

Last audit: 1 May 2021, (UTC+8)

24h high

$0.27440

24h low

$0.26665

All-time high

$0.45000

-39.33% (-$0.17698)

Last updated: 4 Dec 2024, (UTC+8)

All-time low

$0.0067800

+3,926.84% (+$0.26624)

Last updated: 13 Mar 2020, (UTC+8)

Tron Feed

The following content is sourced from .

比特欧 Elvin

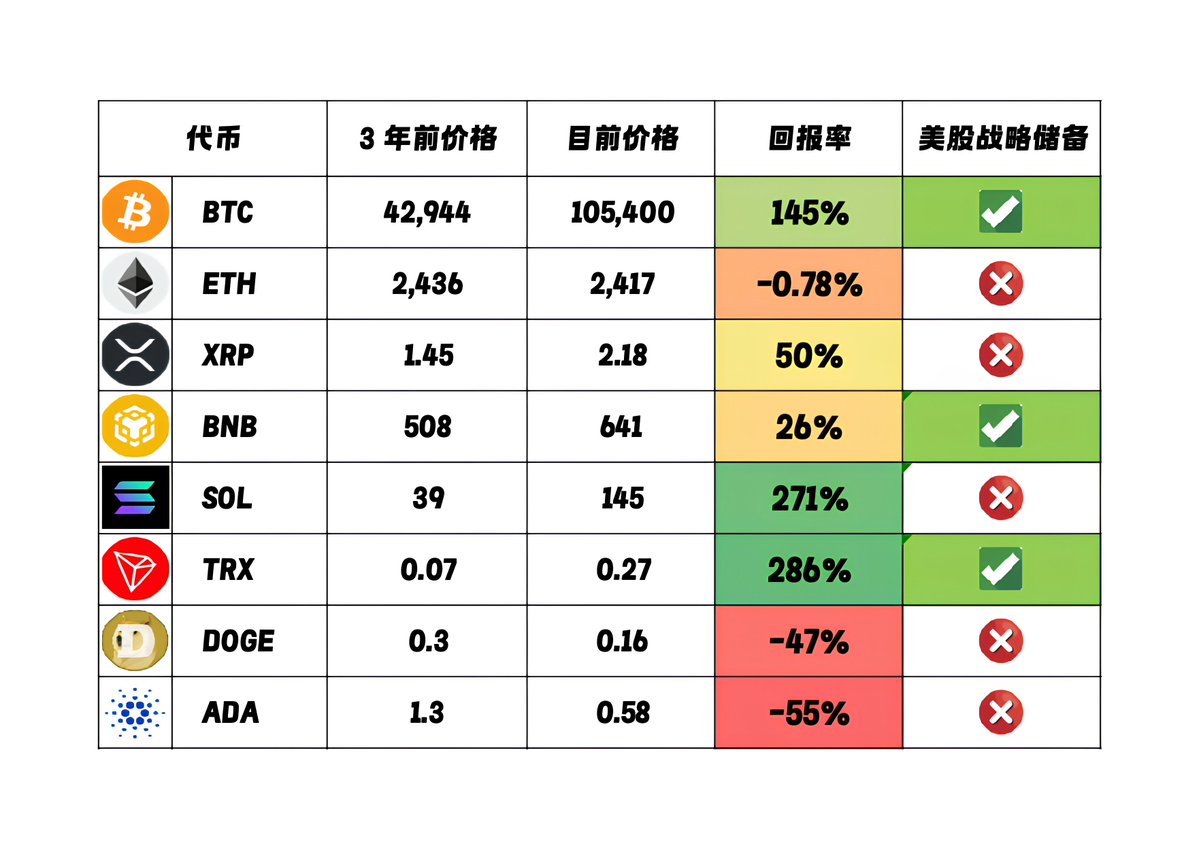

It turns out that Brother Sun's TRON can still outperform BTC in 3 years.

Looking back at the mainstream currency prices in May 2021, Brother Sun's @justinsuntron $TRX turned out to be the highest return token on the list now, and TRX has now become a strategic reserve asset for U.S. stocks. With a 3-year return of nearly 300%, this return is even about 2x the return of $BTC, and it is one of the few altcoins that has outperformed the pie over a long period of time.

$BNB At present, @NanoLabsLtd has planned to hold 5% - 10% of the total circulating supply of $BNB for a long time, which is still a lot, and the next BNB buying should be worth looking forward to.

Compared to Ethereum, the price is almost the same as it is now, 3 years ago.

Show original

5.55K

0

Followin 华语 - 热点风向标🫡

29 listed companies announced "crypto reserves", 20 mainly hoarded BTC, 4 hoarded SOL, 3 hoarded ETH, 1 hoarded HYPE, and 1 hoarded TRX.

The above information comes from BlockBeats, which has a market capitalisation of more than $10 million.

#BTC #SOL #ETH #HYPE #TRX

Show original

11K

0

TechFlow

Written by: Yue Xiaoyu

The currency circle is gradually becoming a U.S. stock market, and now you also need to understand U.S. stocks to play the currency circle.

Since Bitcoin has ETFs, it turned out that only Bitcoin was very close to U.S. stocks, but now people in the cryptocurrency industry are starting to go to U.S. stocks to do things.

Let's take a look at what are the "currency stocks" worth paying attention to at present?

The entire coin stock market is mainly divided into 4 categories:

The first type of stablecoin concept stocks, the benchmark is Circle.

However, the current premium of Circle is very high, and people in the currency circle can't understand it, but people in traditional finance are still rushing hard.

In addition to Circle, companies to watch out for are Tether (unlisted, but USDT dominates the market), Paxos (issuing Pax Dollar, PayPal USD).

The second category is the trading platform, and the benchmark is Coinbase.

But Coinbase assets are already too priced, with stable valuations and limited room for growth.

In addition to Coinbase, Robinhood and Kraken are also worth paying attention to.

Robinhood itself is a traditional stock trading platform, but is actively expanding into cryptocurrency, having just acquired Bitstamp.

Kraken is also a US-compliant exchange, has not yet been listed, is planning an IPO, and if the IPO is successful, it could be considered a strong challenger to Coinbase.

The third category is mining stocks, which are engaged in the bitcoin mining industry.

Typical representatives are Riot Platforms (RIOT), Marathon Digital Holdings (MARA), CleanSpark (CLSK).

Mining stocks are cyclical stocks, with large losses in the cryptocurrency bear market and high returns in the bull market.

Due to the dependence on computing power and energy costs, it will be under pressure from environmental protection policies.

In the long run, the improvement of the status of bitcoin reserve assets is still good for mining stocks.

The fourth category is cryptocurrency vaults, represented by MicroStrategy.

MicroStrategy has created a "financing-buying-pulling" model to raise funds from the market and buy BTC with leverage.

There are also Ethereum micro-strategies, Solana micro-strategies, TRON micro-strategies, and many more.

Many leading cryptocurrency companies are buying shell companies of U.S. stocks, and then raising funds from the U.S. stock market to buy cryptocurrencies in reverse.

This is a great test of the fundraising ability of cryptocurrency companies, which need to have money themselves, such as microstrategies.

For example, SharpLink bought by the Ethereum core circle, and SRM Entertainment bought by Justin Sun of Tron.

But these two are not the same, the former is to raise funds from the market to buy Ethereum, and the latter is to inject his stablecoins and TRX into this US stock company, and then withdraw into US dollars.

So SRM as an asset type can be potentially compliant.

To sum it up

Stablecoins and trading platforms represent "infrastructure" investments, while mining stocks and cryptocurrency vaults are more like "high-risk, high-reward" speculative assets.

The risks of these 4 types of coin stocks are not the same:

(1) The stablecoin concept has the lowest risk, but the growth ceiling is limited, which is suitable for institutional investors who pursue stable returns.

(2) The valuation of the trading platform is high, and it is necessary to pay attention to the ecological expansion ability, which is suitable for investors who are optimistic about the long-term growth of the crypto market.

(3) Mining stocks are highly cyclical, and they need to pay attention to energy and regulatory pressures, which are suitable for cyclical traders, but they need to dynamically adjust their positions in combination with the price of Bitcoin and energy costs.

(4) Cryptocurrency vaults are the most explosive, but they also have the highest leverage and regulatory risks, which is suitable for speculators with a high risk appetite and need to study the company's financing ability in depth.

Currency stocks are merging, on the one hand, stock assets are on the chain, and on the other hand, the assets in the currency circle are listed, and the liquidity of the two markets is opening up in both directions.

We ordinary retail investors should also adjust their thinking and learn relevant knowledge!

Show original4.51K

0

Blockbeats

Original title: "In addition to BTC and ETH, what is the best crypto investment target in 3-5 years in the eyes of these bigwigs?" 》

Original source: TechFlow

"If you had to buy liquid/non-risky cryptocurrencies in a 3-5 year timeframe and were not allowed to buy BTC, ETH, HYPE, SOL or hold stablecoins, what would you buy? Why?"

On June 22, the well-known crypto KOL @Cobie raised the above question on X.

Crypto KOLs, traders, and VC investors have given their "wealth passwords" in the comment area.

We've taken a look at the opinions and choices of some of the biggest names in the industry to see if there's anything you're interested in.

Head of Base jesse.base.eth: Coinbase ($COIN)

Bullish on $COIN (Coinbase) because: (1) it has an incredibly diverse and robust product line that has formed a scaled user base and market-leading brands; (2) It is one of the most executing and visionary on-chain teams in this space, and perhaps even the strongest.

Crypto KOL Ansem: Worldcoin ($WLD)

Hedge OpenAI/Altman's risk in winning the AI race and monitor countries. In the post-AGI era, we need a verifiable way to distinguish between who is human and who is AI. If OpenAI were going to do something with their vast database of individuals in the future, it would most likely have something to do with decentralized identity (WLD).

AllianceDAO Founder qw: A token with strong revenue

In the 3-5 year timeframe, the only correct answer is a token with strong (future) revenue that is currently trading at a reasonable multiple.

Everything else will go to zero. Monetary premiums other than Bitcoin are a thing of the past.

Crypto trader Auri: Starknet ($STRK)

If you think decentralization and privacy are important, follow Starknet

Current Status:

- As an Ethereum L2, it can compete with Solana in terms of TPS (transactions per second).

- Deliver a top-tier user experience with unique AA (Account Abstraction) features and on-chain performance

- Relatively low valuation (fully diluted valuation of $1 billion vs. $3 billion for Arbitrum/Optimism)

There are three paths to success:

- Become a generic layer

- Bitcoin L2 (if settlement on Bitcoin becomes feasible and efficient), this alone I think could multiply Starknet's valuation several times

- If all other paths fail, it can be used as backend infrastructure for other on-chain applications

Mert, founder of Helius Labs: Jito ($JTO), Zcash ($ZEC)

JTO—If you believe that SOL will be around in the next 3-5 years (and it is), then that's pretty self-explanatory

Zcash — I think the privacy coin is coming back, and the chain is about to be redesigned under the new lab body, which is impressive from a technical standpoint

Alex Svanevik, founder of Nansen: Building L1 portfolios

Build a diverse portfolio of Layer 1 (L1) blockchain assets to achieve long-term investment returns. There are already BTC, ETH, HYPE, SOL, and new BNB, SUI, APT, TRX, AVAX, a total of 9 assets, covering mainstream and potential public chains, and staking all assets to obtain about 4.5% annualized return.

Crypto KOL Fishy Catfish: Chainlink ($Link)

Chainlink has maintained its top dominance in terms of market share and security for 6 years (even higher than in 2021)

Real-world asset (RWA) tokenization and stablecoins are two of the largest marketplaces for utility use cases, and Chainlink provides a complete platform for data, connectivity, and computing services in both areas.

Chainlink has been years ahead of its competitors in serving TradFi demand:

A. Coming soon to an automated compliance engine (ACE): Proof of Identity, Proof of Onboarding, Accredited Investor Verification and Sanctions Checks

B. Coming soon to CCID: Cross-Chain Identity System

C. Chainlink has a complete privacy suite (CCIP Private Transactions, Blockchain Privacy Manager, DECO (patented zkTLS))

In addition, it is well ahead of other competitors (including SWIFT, DTCC, JPMorgan Chase, ANZ, UBS, etc.) in terms of traditional finance adoption

Blockchain capture is decreasing, while Chainlink and applications are increasing. For example, the liquidation arbitrage MEV generated by oracle updates, which was previously owned by blockchain validators, is now shared by Chainlink and Aave.

Crypto KOL Murad: $SPX

Why: SPX, as the first "Movement Coin", aims to disrupt the entire stock market. The impact of SPX on GME is comparable to that of BTC on gold, if not worse. It's arguably the most passionate community on crypto Twitter, and it's still in its early stages. It is the only "meme" coin with a real mission. It's the perfect meme vehicle to represent a cultural pushback to the millennial dilemmas and challenges faced by Gen Z around the world. It merges finance with the spiritual world and targets a larger potential market than any other crypto asset ever before. As millions of people begin to lose their jobs and meanings, many will seek tokenized digital shelters, which are one of the strongest rising forces.

APG Capital Trader Awawat: $BNB, $LEO, $AAVE, $MKR, $XMR

Considering this time span, only a few options make sense:

· PAXG/XAUT (Gold Token), it's easy to see why

· BNB/LEO, the upside is limited but the downside risk is also small

· AAVE/MKR: It should be here to stay

· XMR (Monero)

Many of the responses are pitching their portfolios, but objectively speaking, those coins will go to zero over this time horizon

Crypto KOL W3Q: $HOOD, $TSLA

In 5 years, with the exception of Bitcoin, the pure cryptocurrency space will not consider holding.

$HOOD (Robinhood) - Shovels and pickaxes (infrastructure) in retail finance

From betting to mortgages to scaling crypto products, they're moving into all the money-making verticals and have a better user experience and distribution channels than most.

$TSLA (Tesla) - The field of AI robotics covers both software and hardware. Musk may be interested in cryptocurrencies again in the next hype cycle.

If not subject to self-custody, it will be selected

Bitcoin ETF with 2x leverage

Use a portion of your portfolio layout at market cycle lows or extreme sell-offs.

Vance Spencer, Partner, Framework Ventures: $SKY

$SKY, it's important to note that it's not currently on any CEXs.

Arthur, founder of DeFiance Capital: $AAVE, $ENA, $PENDLE, $JUP

The above are their investment choices, so what do you see as a long-term investment target for 3-5 years?

Link to original article

Show original

26.66K

0

Tron price performance in USD

The current price of Tron is $0.27302. Over the last 24 hours, Tron has increased by +0.72%. It currently has a circulating supply of 94,813,102,891 TRX and a maximum supply of 94,813,496,053 TRX, giving it a fully diluted market cap of $25.85B. At present, Tron holds the 0 position in market cap rankings. The Tron/USD price is updated in real-time.

Today

+$0.0019600

+0.72%

7 days

-$0.00613

-2.20%

30 days

+$0.00012000

+0.04%

3 months

+$0.041640

+17.99%

Popular Tron conversions

Last updated: 24/06/2025, 21:45

| 1 TRX to USD | $0.27265 |

| 1 TRX to PHP | ₱15.5303 |

| 1 TRX to EUR | €0.23487 |

| 1 TRX to IDR | Rp 4,450.70 |

| 1 TRX to GBP | £0.20028 |

| 1 TRX to CAD | $0.37393 |

| 1 TRX to AED | AED 1.0013 |

| 1 TRX to VND | ₫7,133.70 |

About Tron (TRX)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Latest news about Tron (TRX)

Tron Inc. Deal Gives Justin Sun’s Father Control of Public Firm Via $100M Token Deal

Justin Sun's father, Weike Sun, was appointed Chairman of the Board, and Tron-affiliated executives were added to key board committees.

18 Jun 2025|CoinDesk

Asia Morning Briefing: Tron's Public Listing Might Be Investors' 'Visa' Moment for Stablecoins

If stablecoins are the future of payments, Tron Inc., not Circle, might be how investors get exposure to these new financial rails, especially in emerging markets.

17 Jun 2025|CoinDesk

Eric Trump says he loves Justin Sun but denies involvement in Tron’s public debut plan

Eric Trump on Monday denied involvement in Tron’s reported public market debut plan, despite being...

17 Jun 2025|Crypto Briefing

Learn more about Tron (TRX)

TRON 5.0: Revolutionizing Blockchain Scalability, Interoperability, and DeFi Innovation

TRON Mainnet Upgrade: A Comprehensive Guide to TRON 5.0 Introduction: TRON's Evolution in the Blockchain Space TRON has established itself as a pioneering blockchain platform, consistently driving innovation in decentralized applications (dApps), scalability, and interoperability. With the highly anticipated TRON 5.0 upgrade, the network is set to introduce transformative features that aim to enhance its ecosystem and solidify its position as a leader in the blockchain industry. This article delves into the latest TRON developments, technical upgrades, and their implications for users, developers, and the broader crypto community.

24 Jun 2025|OKX

TRC20-USDT Hits Record Highs: How TRON’s Stablecoin is Shaping the Future of DeFi

TRC20-USDT Issuance Milestones and Growth TRC20-USDT, the stablecoin issued on the TRON blockchain, has achieved remarkable milestones, solidifying its position as a key player in the cryptocurrency ecosystem. As of recent reports, over 71.7 billion tokens have been issued, accounting for approximately 47.6% to 60% of the total USDT supply. This growth reflects the increasing demand for TRC20-USDT and its pivotal role in the stablecoin market.

24 Jun 2025|OKX

TRON's Explosive Growth: Stablecoin Dominance, Whale Activity, and DeFi Expansion

TRON's Rise in the Crypto Ecosystem TRON (TRX) has emerged as one of the most dynamic and resilient blockchain networks in the cryptocurrency space. With consistent growth in transaction volume, dominance in stablecoin infrastructure, and a rapidly expanding DeFi ecosystem, TRON is solidifying its position as a critical player in the global crypto landscape. This article explores TRON's key milestones, unique strengths, and its role in shaping the future of blockchain technology.

23 Jun 2025|OKX

Tron Blockchain's Nasdaq Listing: A Game-Changer for Crypto Investors

Introduction: Tron Blockchain's Bold Move to Nasdaq Tron blockchain, led by its controversial founder Justin Sun, is making headlines with its ambitious plan to go public in the United States. This move, facilitated through a reverse merger with Nasdaq-listed SRM Entertainment, marks a significant milestone for the blockchain industry. With ties to prominent figures like Eric Trump and a strategy reminiscent of MicroStrategy's Bitcoin playbook, Tron Inc. is poised to reshape the crypto investment landscape.

17 Jun 2025|OKX

Tron FAQ

How much is 1 Tron worth today?

Currently, one Tron is worth $0.27302. For answers and insight into Tron's price action, you're in the right place. Explore the latest Tron charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Tron, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Tron have been created as well.

Will the price of Tron go up today?

Check out our Tron price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials