STETH

Lido Staked Ether price

$2,424.59

+$139.63

(+6.11%)

Price change for the last 24 hours

How are you feeling about STETH today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Lido Staked Ether market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$22.11B

Circulating supply

9,160,619 STETH

100.00% of

9,160,606 STETH

Market cap ranking

--

Audits

Last audit: 30 Jul 2022, (UTC+8)

24h high

$2,448.02

24h low

$2,196.23

All-time high

$4,100.91

-40.88% (-$1,676.32)

Last updated: 17 Dec 2024, (UTC+8)

All-time low

$1,384.79

+75.08% (+$1,039.80)

Last updated: 9 Apr 2025, (UTC+8)

Lido Staked Ether Feed

The following content is sourced from .

Level 🆙

5 designs, 5 paths to yield.

Smart capital isn’t just yield-seeking, it’s risk-aware.

Level 🆙

Stablecoin Yields Aren’t All Built the Same

Yield-bearing stablecoins are becoming a core part of DeFi’s capital base. But not all yield is created equal and the mechanisms vary widely.

At @levelusd, reserves are routed through onchain lending markets. Others deploy capital into tokenized Treasuries. Some rely on synthetic hedging or rebasing mechanics.

Each design carries trade-offs: transparency, composability, scalability.

Over time, only a few have proven durable.

Here’s a breakdown of the five different models, and why the most resilient systems still center around one thing: lending.

1️⃣ Lending-Backed Yield

Deposits go into protocols like @aave or @morpholabs. Borrowers pay interest. Yield flows to holders, either directly or via wrappers like slvlUSD.

→ Fully onchain

→ Variable but composable

→ No intermediaries

Level uses this model. For a reason.

2️⃣ Tokenized Treasuries (RWA-Backed)

Reserves are parked in tokenized T-bills or similar TradFi instruments. Yield is streamed or rebased via custodians.

→ Predictable returns

→ Permissioned rails

→ Custody risk

TradFi-aligned, but can struggle to integrate with DeFi systems.

3️⃣ Delta-Neutral Hedging

Backed by ETH, stETH or similar assets, paired with short perps to neutralize price exposure. Yield comes from funding rate arbitrage.

→ Onchain mechanics

→ High APY in bull runs

→ Complex and brittle

These work, until they don’t.

4️⃣ Crypto-Collateralized & Algorithmic Stablecoins

These stablecoins often rely on crypto collateral and algorithmic design. Their yield tends to come from minting fees, borrowing interest, or token incentives.

→ Fully onchain and non-custodial

→ Can maintain peg with market incentives

→ Exposed to depeg risk and complex feedback loops

Volatility can significantly impact the stability and sustainability of this model.

5️⃣ Vault Wrappers

The stablecoin itself remains fungible and money-like. Yield is opt-in via a secondary token (e.g. slvlUSD), which accrues interest from defined strategies.

→ Modular and transparent

→ Preserves usability

→ Frictionless integrations

This is the foundation of Level’s design.

The takeaway:

Yield isn't created equally, and the mechanism behind it matters.

When deciding where to allocate your capital, consider custody models, composability, and the volatility of different stablecoins.

For a protocol aiming to build an on-chain bank, only one mechanism consistently delivers battle-tested performance, transparency, and scale: lending yield.

Level 🆙

1.94K

0

币世王

The Ultimate SparkFi Edition!

After several weeks of discussions, it's clear that everyone is really giving their all and using their best skills to stick with it until now! It's truly wonderful to sprint and communicate together! The last few hours of Spark SNAPS, leave a comment on this post to interact together!

This article will summarize all the pieces I've written so far~

▰▰▰▰▰

Three Major Protocols Achieve SparkFi!

▪ SparkLend Lending Platform: Connecting real users with asset liquidity needs, it is the largest usage place for USDS!

▪ SLL (Spark Liquidity Layer): An on-chain capital deployment engine that dynamically allocates billions of dollars in liquidity to the most optimal yield markets!

▪ SSR (Sky Savings Rate): Building the most attractive stablecoin yield system, supporting the confidence of USDS and sUSDS depositors!

The three form a self-circulating on-chain financial yield:

Depositors deposit USDS → SLL allocates funds → Deployed to SparkLend/Morpho/BlackRock, etc. → Yield flows back → Supports SSR → Enhances USDS attractiveness → Continuous user growth

▰▰▰▰▰▰

Real On-Chain Yield Data!

As of now, the total amount of funds allocated by Spark has exceeded 3.1 billion dollars, of which:

▪ 900 million dollars allocated to SparkLend

▪ 800 million dollars deployed to BlackRock BUIDL

▪ 500 million dollars entered Morpho strategy pool

▪ 300 million dollars directly allocated to Ethena's sUSDe/sUSDS

Total yield has exceeded 100 million!

▰▰▰▰▰▰

Ecosystem Integration, Complementary and Beneficial

SparkFi's integration strategy is not a one-way access but a two-way collaboration:

▪ With Chainlink: Achieving high-security oracle services for collateral asset price updates

▪ With Lido / Rocket Pool: Accessing stETH and other staked assets for compounded yields

▪ With Balancer / Curve: Integrating liquidity pools to enhance USDS usage

▪ With Morpho / Aave / Pendle / Ethena: Deploying efficient structured yield pools

▪ With Symbiotic: Launching Ignition / Overdrive staking airdrop mechanisms

These integrations allow every asset of Spark to flow, no longer just idle funds, but a machine for generating liquid yields!

▰▰▰▰▰▰

Final Words

I have written about Spark's lending system, SLL's capital allocation, SSR's yield model, SPK's value logic, and even tracked every staking data and transaction dynamics!

From the story to the structure, I have witnessed its transformation from a DeFi module to an on-chain system alongside everyone. If this is the first chapter of SparkFi, then now, SPK has just turned the page!

What you see is not just an ordinary token, but a yield aggregator of the new generation of on-chain financial systems!

@cookiedotfun @cookiedotfuncn #sparkfi @sparkdotfi $SPK

Show original

20.66K

0

ml_sudo

I think this is what Vitalik meant by not wanting any random project to claim ETH values while behaving like this

From their docs: “all while maintaining the rigorous security standards of the Ethereum mainnet”

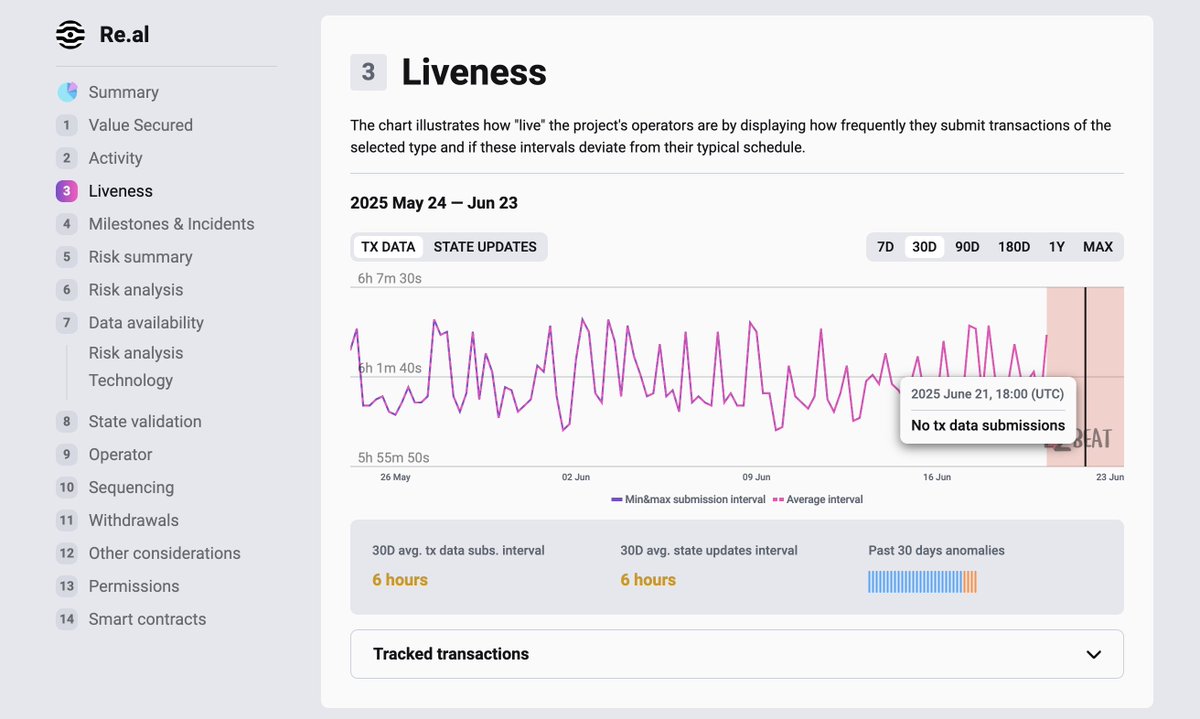

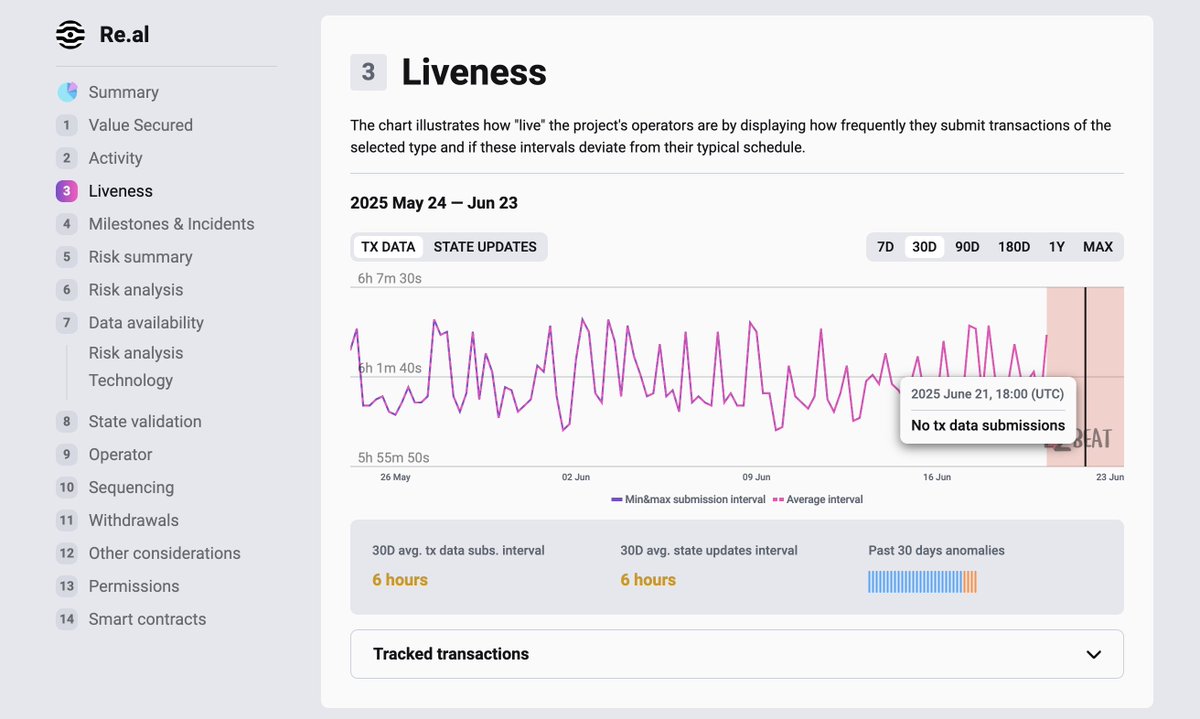

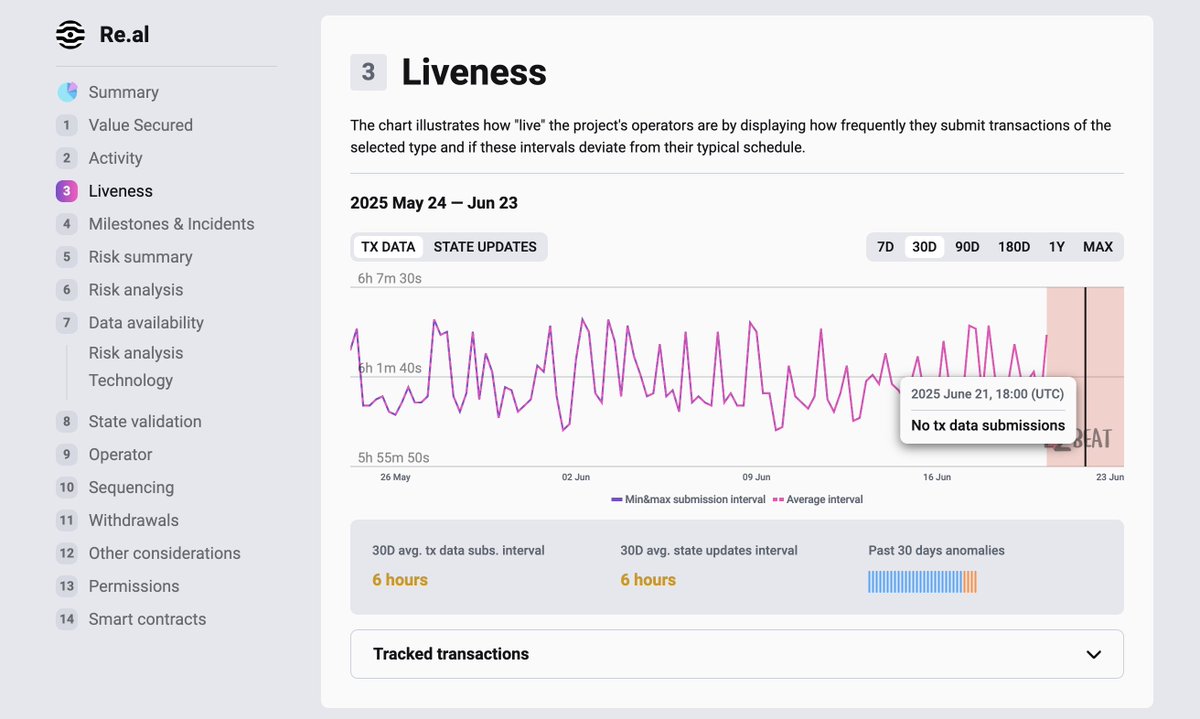

donnoh.eth 💗

apparently @real_rwa has fully halted block production and state updates for their Orbit stack chain without any announcement. $500K in stETH & USDC are still locked in the chain with no way to force exits

exit windows are not a meme 🙃

21.12K

1

tim-clancy.eth

Anyone who has shipped a product without an exit window should be deeply ashamed of themselves. To do so is a deliberate choice in failing to prioritize user security. To do so is to let Ethereum down.

donnoh.eth 💗

apparently @real_rwa has fully halted block production and state updates for their Orbit stack chain without any announcement. $500K in stETH & USDC are still locked in the chain with no way to force exits

exit windows are not a meme 🙃

30.8K

0

tk ⛽️

there's ~$1m+ of real money here (eth/real stables); no updates from the team (in months...), all the RPCs are off, there's no public way to run a node, no blocks, can't exit, guardians and data gang are nowhere to be found.

@real_rwa, this is just wrong. this is real people's money.

donnoh.eth 💗

apparently @real_rwa has fully halted block production and state updates for their Orbit stack chain without any announcement. $500K in stETH & USDC are still locked in the chain with no way to force exits

exit windows are not a meme 🙃

38.26K

39

Lido Staked Ether price performance in USD

The current price of Lido Staked Ether is $2,424.59. Over the last 24 hours, Lido Staked Ether has increased by +6.11%. It currently has a circulating supply of 9,160,619 STETH and a maximum supply of 9,160,606 STETH, giving it a fully diluted market cap of $22.11B. At present, Lido Staked Ether holds the 0 position in market cap rankings. The Lido Staked Ether/USD price is updated in real-time.

Today

+$139.63

+6.11%

7 days

-$128.67

-5.04%

30 days

-$69.3100

-2.78%

3 months

+$414.61

+20.62%

Popular Lido Staked Ether conversions

Last updated: 24/06/2025, 21:46

| 1 STETH to USD | $2,414.00 |

| 1 STETH to PHP | ₱137,502.6 |

| 1 STETH to EUR | €2,079.51 |

| 1 STETH to IDR | Rp 39,405,811 |

| 1 STETH to GBP | £1,773.25 |

| 1 STETH to CAD | $3,310.69 |

| 1 STETH to AED | AED 8,865.35 |

| 1 STETH to VND | ₫63,160,649 |

About Lido Staked Ether (STETH)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Lido Staked Ether FAQ

How much is 1 Lido Staked Ether worth today?

Currently, one Lido Staked Ether is worth $2,424.59. For answers and insight into Lido Staked Ether's price action, you're in the right place. Explore the latest Lido Staked Ether charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Lido Staked Ether, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Lido Staked Ether have been created as well.

Will the price of Lido Staked Ether go up today?

Check out our Lido Staked Ether price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.