Understanding the cryptocurrency market

The cryptocurrency market is incredibly dynamic and fast-paced. Whether you're trading or working in the industry, staying updated on market movements, token trends, and relevant news is crucial. This includes understanding regulatory updates, technological advancements (both onchain and offchain), and significant market events — past and future — that influence token prices.

Events like bank runs or incidents involving major exchanges (such as FTX) can directly impact the market, while broader events like U.S. presidential elections can affect market sentiment. Although we can never keep gain visibility to every development given how fast crypto moves, staying informed on the major events can help traders to make better decisions and spot potential opportunities. We believe that the four factors outlined below can provide you with a fundamental blueprint to follow to get started with understanding the market, trends and token movements, and how to potentially reduce risk.

Trend reading 101

Effective trading requires a deep understanding of market trends. This can be achieved through:

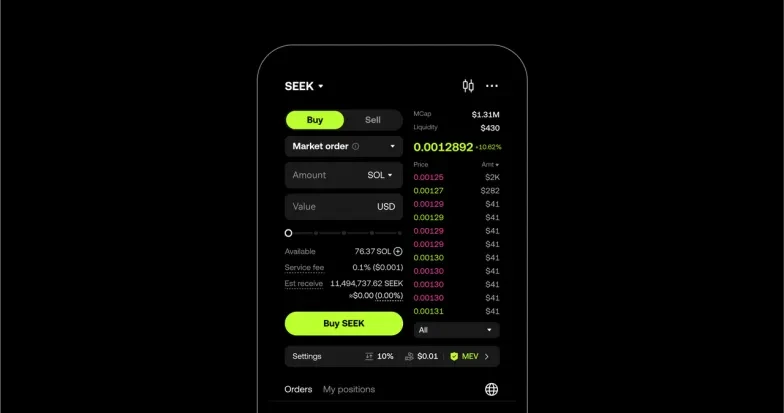

Fundamental analysis: On the macro level, traders will examine the overall market situation using tools like OKX's market discovery feature and the Opportunities section, which highlights trending tokens, top gainers, and more.

You can also delve into specific tokens by pairing larger timeframe charts (weekly/monthly) with relevant news events to observe how those events impacted the token's value. This can help you to understand the token's characteristics and behavior, so you can make more informed decisions.

Technical analysis: Technical analysis involves using price action and trading tools to understand token movements, identify support and resistance levels, and more. Traders typically start with higher timeframes like monthly or quarterly charts and then move down to their preferred entry timeframe. The example chart below shows support lines from the monthly analysis down to the one-hour timeframe:

Chart Source: OKX

At the entry timeframe, traders might use advanced tools for greater confluence. Some popular tools include combining moving averages with Heikin Ashi candles and adding Fibonacci retracement where relevant. Many traders prefer to identify at least three points of confluence before placing a trade. Every trader has unique preferences, so no two trading strategies are identical. Applying thorough research to find the right approach for your experience level and risk tolerance is therefore key, so you can trade with confidence.

Trading styles and managing trades

Trading styles vary widely, but here are four general types:

Swing trading: Holding positions for several days or weeks to make gains from expected price changes. This approach typically involves two to three trades per month per token.

Scalp trading: For advanced traders who exploit small price movements within seconds to minutes, making numerous trades throughout the day.

Intraday trading: Similar to scalping but on slightly longer timeframes within the same day, often using news and fundamentals. Traders buy and sell within the same trading day, and are at their most active during news periods.

Limit orders and take-profit/stop-loss: Traders set specific buy (limit) or sell points and use take-profit/stop-loss orders to manage risk and secure gains.

Leveraging tools for trading automation

To reduce the need for constant monitoring and manual trading, traders can use automation tools like trading bots. These bots can execute trades based on pre-set conditions, ensuring timely and precise entries and exits without the need for direct intervention.For starters, the spot grid, futures grid, smart portfolio, and recurring buy are the most straightforward bots to use. Click on the two links below for a more detailed explanation of the range of Bots OKX offers.

Choosing between copy trading, bots, and signals

Although today's automated trading tools share some similarities, there are key differences to be aware of. Let's take a look at what each of these tools are:

Copy trading: Allows a trader to replicate the trades of experienced traders, and benefit from their expertise.

Trading bots: Use algorithms to automate trades based on specific strategies.

Signal bots: Provide alerts or recommendations on potential trades, which can then be automatically executed through a bot.

By understanding these tools and strategies, traders can navigate the cryptocurrency markets more effectively, mitigate risks, and enhance their trading performance. Whether you're a novice or an experienced trader, leveraging automation can help you stay ahead in the ever-evolving crypto landscape. Check out the Trading section of the OKX Learn platform for many different insightful articles to help you take the right steps forward on your trading journey.