CRV

Curve DAO Token price

$0.51180

+$0.00030000

(+0.05%)

Price change for the last 24 hours

Curve DAO Token market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$698.14M

Circulating supply

1,366,752,939 CRV

45.10% of

3,030,303,031 CRV

Market cap ranking

43

Audits

Last audit: --

24h high

$0.52190

24h low

$0.49610

All-time high

$63.0000

-99.19% (-$62.4882)

Last updated: Aug 14, 2020, (UTC+8)

All-time low

$0.18010

+184.17% (+$0.33170)

Last updated: Aug 5, 2024, (UTC+8)

How are you feeling about CRV today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Curve DAO Token Feed

The following content is sourced from .

crv.mktcap.eth

This time, it's not a drill!

Vote @CurveFinance early and vote often!

OpenStableIndex

$OPEN Stablecoin Index vote is LIVE (2nd try).

🔢 12 tokens proposed

🎯Only 10 make the index

🗳️vlSQUILL holders decide

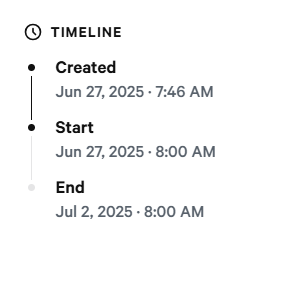

Snapshot vote is live till July 2:

Catchup on the RFC discussion:

Qualifying ecosystems:

@CurveFinance

@Reserveprotocol

@LiquityProtocol

@Aave

@InverseFinance

@FraxFinance

@SkyEcosystem

@Protocol_Fx

@AlchemixFi

@OriginProtocol

@ethena_labs

@maplefinance

2.23K

21

Yishi

@newmichwill is pushing the resupply team to do the right thing, and he’s shown real accountability. three wallets have already stepped in to cover the hole. now i just hope they track down the hacker, recover the stolen funds, and make sure every investor gets what they deserve.

Yishi

as one of the top three investors in the resupply project, with millions of dollars at stake, this incident has caused not only significant financial loss, but also intense psychological pressure. yet simply for raising reasonable concerns in the official discord, i was muted without cause. that kind of response is unacceptable.

at this point, debating the definition or mechanics of the insurance pool is meaningless. i want to make my position clear:

1/ many investors, myself included, only dared to commit this level of capital because resupply was presented as having the credibility of curve behind it. let’s be honest. if teams like curve, convex, and yearn had not publicly or privately signaled involvement, few would have touched a new protocol like this with size. now, those same parties are distancing themselves, which is infuriating.

2/ this loss was not caused by market volatility or a bad debt event. it was a critical technical failure — an erc4626 inflation bug that happened because the team failed to burn initial shares when deploying a new vault. this allowed an attacker to mint unlimited shares at almost no cost and drain the assets. this is a protocol-level issue and a severe oversight.

3/ in any security incident, the first step should be to investigate the exploit and protect user funds. instead, the resupply team’s first reaction was to push losses onto insurance pool depositors, while silencing and mocking those who disagreed. i have been in defi for years. i have never seen a team act with such a lack of accountability.

4/ the insurance pool was never meant to cover technical failures by the development team. if protocol creators start treating user funds as a backstop for their own mistakes, they are effectively saying that depositors exist to take the hit. insurance is meant to cover black swan events and market risk, not internal negligence.

5/ there is no defi precedent where an insurance pool covers damage from a bug caused by the protocol team. if resupply intended that, it should have been clearly stated in the docs. it was not. instead, the team continues to twist the narrative in discord while muting anyone who pushes back.

6/ curve and crvusd benefited materially from resupply. they should not be allowed to walk away from this. the exploit was not a market issue. it was a critical design and deployment flaw. responsibility lies with the team, not the users.

7/ c2 stepping up personally to cover around 1.5 million dollars shows character. but that cost should not fall on one individual. it should come from convex or yearn’s treasury if they still stand by the project they helped launch.

8/ i respect what michael has done for curve, and i appreciate his effort to mediate throughout this situation. but that does not mean i will back down.

9/ what i and every resupply investor need now is a fair resolution. return the user funds that were lost due to your own mistake. do the right thing.

1.6K

10

凉粉小刀

Firmly support Yishi, the founder who lies in tens of millions of mansions every day should have gotten out of the stage of history a long time ago

Yishi

as one of the top three investors in the resupply project, with millions of dollars at stake, this incident has caused not only significant financial loss, but also intense psychological pressure. yet simply for raising reasonable concerns in the official discord, i was muted without cause. that kind of response is unacceptable.

at this point, debating the definition or mechanics of the insurance pool is meaningless. i want to make my position clear:

1/ many investors, myself included, only dared to commit this level of capital because resupply was presented as having the credibility of curve behind it. let’s be honest. if teams like curve, convex, and yearn had not publicly or privately signaled involvement, few would have touched a new protocol like this with size. now, those same parties are distancing themselves, which is infuriating.

2/ this loss was not caused by market volatility or a bad debt event. it was a critical technical failure — an erc4626 inflation bug that happened because the team failed to burn initial shares when deploying a new vault. this allowed an attacker to mint unlimited shares at almost no cost and drain the assets. this is a protocol-level issue and a severe oversight.

3/ in any security incident, the first step should be to investigate the exploit and protect user funds. instead, the resupply team’s first reaction was to push losses onto insurance pool depositors, while silencing and mocking those who disagreed. i have been in defi for years. i have never seen a team act with such a lack of accountability.

4/ the insurance pool was never meant to cover technical failures by the development team. if protocol creators start treating user funds as a backstop for their own mistakes, they are effectively saying that depositors exist to take the hit. insurance is meant to cover black swan events and market risk, not internal negligence.

5/ there is no defi precedent where an insurance pool covers damage from a bug caused by the protocol team. if resupply intended that, it should have been clearly stated in the docs. it was not. instead, the team continues to twist the narrative in discord while muting anyone who pushes back.

6/ curve and crvusd benefited materially from resupply. they should not be allowed to walk away from this. the exploit was not a market issue. it was a critical design and deployment flaw. responsibility lies with the team, not the users.

7/ c2 stepping up personally to cover around 1.5 million dollars shows character. but that cost should not fall on one individual. it should come from convex or yearn’s treasury if they still stand by the project they helped launch.

8/ i respect what michael has done for curve, and i appreciate his effort to mediate throughout this situation. but that does not mean i will back down.

9/ what i and every resupply investor need now is a fair resolution. return the user funds that were lost due to your own mistake. do the right thing.

4.6K

11

Convert USD to CRV

Curve DAO Token price performance in USD

The current price of Curve DAO Token is $0.51180. Over the last 24 hours, Curve DAO Token has increased by +0.06%. It currently has a circulating supply of 1,366,752,939 CRV and a maximum supply of 3,030,303,031 CRV, giving it a fully diluted market cap of $698.14M. At present, Curve DAO Token holds the 43 position in market cap rankings. The Curve DAO Token/USD price is updated in real-time.

Today

+$0.00030000

+0.05%

7 days

-$0.05520

-9.74%

30 days

-$0.25100

-32.91%

3 months

+$0.022800

+4.66%

Popular Curve DAO Token conversions

Last updated: 06/28/2025, 08:40

| 1 CRV to USD | $0.51080 |

| 1 CRV to PHP | ₱28.8949 |

| 1 CRV to EUR | €0.43581 |

| 1 CRV to IDR | Rp 8,290.86 |

| 1 CRV to GBP | £0.37228 |

| 1 CRV to CAD | $0.70038 |

| 1 CRV to AED | AED 1.8759 |

| 1 CRV to VND | ₫13,329.85 |

About Curve DAO Token (CRV)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Curve DAO Token FAQ

What is Curve DAO?

Curve DAO governs Curve Finance by enabling its users to vote on crucial project developments. However, for votes to matter, users must first have a financial stake in the project.

What are the benefits of holding CRV?

Beyond governance capabilities, CRV holders can earn through liquidity mining and staking. In addition, they receive a portion of transaction fees.

What is the CRV price prediction?

While it’s challenging to predict the exact future price of CRV, you can combine various methods like technical analysis, market trends, and historical data to make informed decisions.

How much is 1 Curve DAO Token worth today?

Currently, one Curve DAO Token is worth $0.51180. For answers and insight into Curve DAO Token's price action, you're in the right place. Explore the latest Curve DAO Token charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Curve DAO Token, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Curve DAO Token have been created as well.

Will the price of Curve DAO Token go up today?

Check out our Curve DAO Token price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to CRV