From President Trump returning to the White House to political coins, tariff trade wars, a hawkish Fed, and a shifting global economy, the winds of volatility have hit the crypto market like tornadoes. Confusion is rampant, traders are second-guessing every move, and markets are swinging unpredictably. In times of uncertainty and volatility, how do you separate the facts from the FUD and FOMO?What's the best approach to seeing the bigger picture?In this guide you'll discover information that can help you create opportunities.

Disclaimer

The following game plan is a personal opinion piece based on collective learnings from seasoned traders and personal experience. It’s designed to help structure your approach to the market, encourage confluence-based decision-making, and adapt to your life and trading style, including risk tolerance. This guide is not a replacement for conducting your own market research, but only meant to assist you in conducting such research. This is not intended to provide (i) investment, financial, accounting, legal or tax advice, or (ii) an offer or solicitation to buy, sell or hold digital assets.

The Game Plan: Positioning is King

First: Create Your Personal Trading Checklist Before making a single trade:

Clarity of thought – start your trading day with your trade hypothesis and the evidence supporting your directional bias/trade idea.

You are trading, not gambling – Stick to the process, not emotions.

Next: Cover all grounds with Technical & Macro Analysis Every Monday, before the US market opens, dedicate time to analyzing key indicators:

Market-Wide Analysis

Total Crypto Market Cap (with & without BTC & ETH)

Bitcoin Chart – The market's main directional driver

Higher Timeframe Analysis

Weekly & daily timeframes for trend confirmation

Identify major support & resistance levels

Macro & Fundamental Data

US Dollar strength & interest rates

US political climate & regulatory trends

Volume flows & on-chain activity

Technical Indicators for Confluence

Use at least two additional indicators to confirm directional bias

Ensure your support & resistance align with macro trends

Trade Execution – Strategy & Risk Management

Limit Your Exposure & Diversify

Trade a maximum of 3 tokens unless you have the time, bandwidth, and liquidity to manage risk.

Diversify across tokens with differing growth indicators, not just within a single sector.

Positioning Entries & Exits

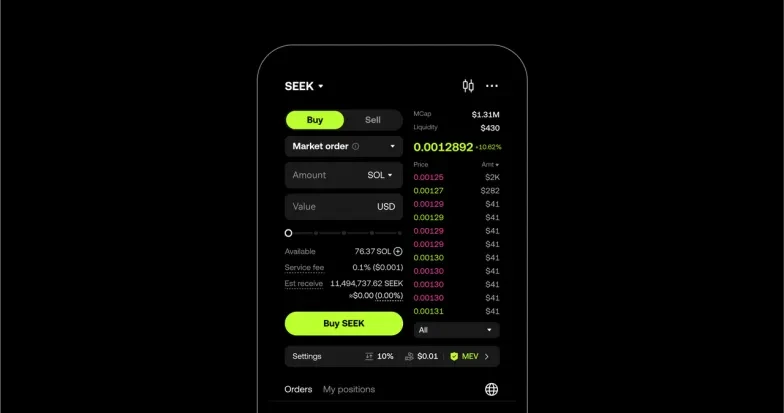

Set trades near key support/resistance levels – No chasing.

If you miss an entry, wait for the next retracement.

Use limit orders for entries instead of market buys.

Profit-Taking & Risk Management

Take-Profit (TP) Plan – Too many traders round-trip their profits due to greed. Have clear TP levels and lock in gains.

Stop-Loss (SL) Discipline – Cut losses fast instead of waiting for an imaginary bounce. The "it might recover" mindset leads to bigger losses and liquidation.

Capital Allocation & Leverage

Do not overtrade – Focus on 2-3 high-conviction setups per week.

Do not risk more than 50% of your capital per trade if you're leveraging multiple tokens.

A sample 5-Step Weekly Game Plan

1. Monday: 1.5 Hours Before US Market Open

Chart the Total Crypto Market Cap

Chart BTC – Identify macro trends

Chart your trading tokens – Look for confluence

*Need help with charting? Read our Charting 101 Guide

2. News & Sentiment Analysis

Token-specific news from TradingView aggregators

Updates from OKX Social Feed

Insights from Twitter Trading KOLs – TraderXO, Trade Travel Chill, etc.

Monitor Trump’s tweets & US political events

Broader market risk sentiment analysis - is it a risk-on or risk-off day today? (check earlier opened markets and look for confluence/agreement with the open. e.g. Australian markets open up, Asian markets the same, Europe opens up. If confluence across continents/markets, the likelihood of the US opening up means today has a statistically probably "risk on" day. i.e. No flight to quality or hedging (buying gold, treasuries, etc), meaning it's positive for risker assets (like crypto).

3. Formulate a Directional Bias

Bullish? Bearish? Neutral? Align all factors before execution.

4. Execute & Position Trades

Set target entries, TP, and SL orders accordingly.

Take into consideration volatility when placing your orders. e.g. If the asset you are trading has an average of (say) 100 in volatility, placing orders within 100 (from current prices) will have a statistical probability of being reached/hit/filled. If you are looking to preserve capital with (say) a stop loss order, placing stop loss orders outside of volatility will keep you in the trade. However, position sizing takes precedent over volatility ranges. Consider volatility ranges to ensure they are within your capital preservation thresholds. There are multiple indicators that can show you volatility: Average True Range (ATR), Bollinger Bands and Keltner Channel indicator. *The indicators chosen are some of the most useful and popular among traders when it comes to measuring volatility. They aren't necessarily the best indicators by any specific measure, and using them doesn’t guarantee a positive outcome on your trades.

5. Detach from the Market & Live Your Life

Once positioned, step away. No emotional trading. Limit orders and automated trading can help you remain disciplined.

Trade to live, don’t live to trade.

How to Position Entries & Optimize Execution

Limit Buy/Sell Orders – Secure entries/exits on targeted levels. Read more here.

TP/SL Orders – Lock in gains & minimize losses on preset levels. Read more here.

Grid / DCA Bots – Automate trading on Grid or DCA strategy. Read more on Grid or DCA bots here.

Smart Tools for Traders of All Levels

If you want to trade smarter without manual execution, leverage OKX’s trading automation tools:

1. Copy Trading – Mirror the strategies of top-performing traders effortlessly. Read more here.

2. Smart Picks – Access battle-tested trading strategies used by pros. Read more here.

3. Trading Bots – Automate entries, exits, and rebalancing to remove emotion from trading. Read more here.

Volatility is inevitable. But a well-structured approach, risk management, and strategic positioning separate seasoned traders from emotional gamblers.

Lastly, this game plan is an opinion piece. Many traders have different formats/structures they use that fits their lifestyle and trading style. The above is to be used only a guide if you need help getting started, and definitely do tweak it to fit your lifestyle and trading style. Most importantly, trading safe! We hope this helps.

Get positioned, Trade smarter.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” Some content may be generated or assisted by artificial intelligence (AI) tools. No derivative works or other uses of this article are permitted.