PYTH

Pyth Network price

$0.096100

+$0.0031000

(+3.33%)

Price change for the last 24 hours

How are you feeling about PYTH today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Pyth Network market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$555.45M

Circulating supply

5,749,986,206 PYTH

57.49% of

10,000,000,000 PYTH

Market cap ranking

--

Audits

Last audit: 3 Jun 2021, (UTC+8)

24h high

$0.10000

24h low

$0.092600

All-time high

$1.1600

-91.72% (-$1.0639)

Last updated: 16 Mar 2024, (UTC+8)

All-time low

$0.060000

+60.16% (+$0.036100)

Last updated: 20 Nov 2023, (UTC+8)

Pyth Network Feed

The following content is sourced from .

TOP 7 ICO | Crypto News & Analytics

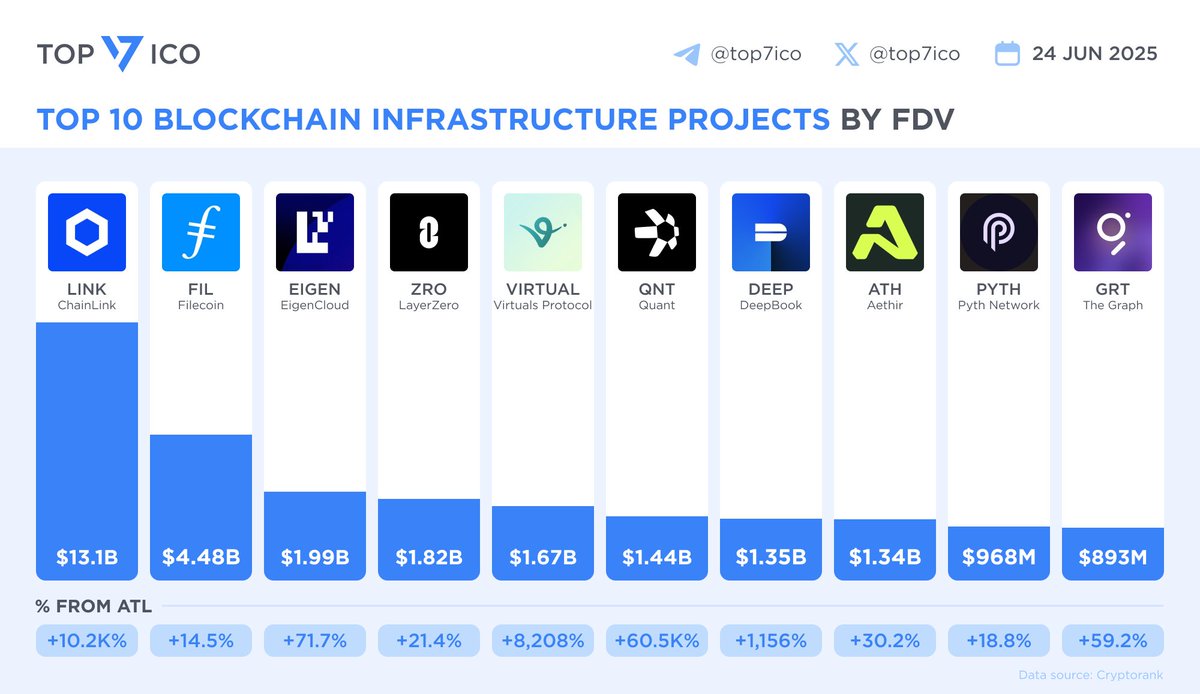

Top 10 Blockchain Infrastructure Projects by Fully Diluted Valuation

Here’s a look at the most valuable Blockchain Infrastructure projects by FDV. $LINK leads with $13.1B, followed by $FIL, $EIGEN, $ZRO, $VIRTUAL, $QNT, $DEEP, $ATH, $PYTH and $GRT

Data source 🔗 @CryptoRank_io

Show original

8.58K

0

Santiment

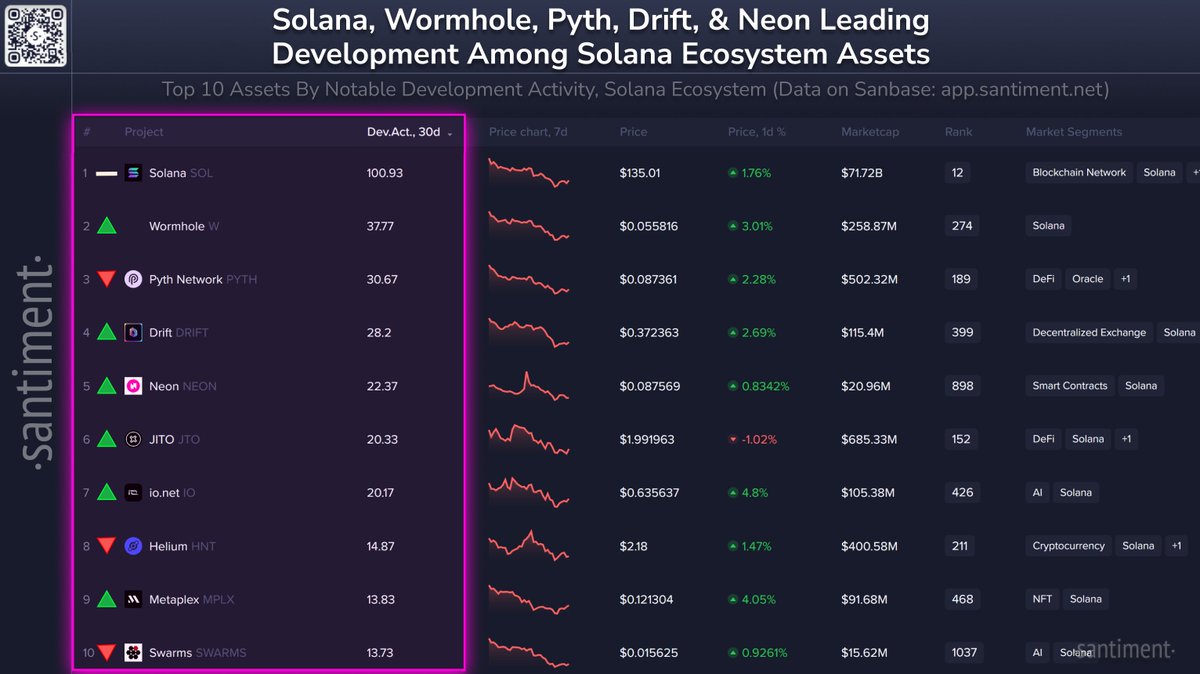

🧑💻 Here are crypto's top Solana ecosystem projects by development. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) @solana $SOL 🥇

📈 2) @wormholefdn $W 🥈

📉 3) @pythnetwork $PYTH 🥉

📈 4) @driftprotocol $DRIFT

📈 5) @neonlabsorg $NEON

📈 6) @jito_sol $JTO

📈 7) @ionet $IO

📉 8) @helium $IOT

📈 9) @metaplex $MPLX

📉 10) @swarms_corp $SWARMS

📖 Read about @santimentfeed's methodology for covering development activity for each project, objectively, using enhanced github event data:

Show original

19.2K

31

ChainCatcher 链捕手

Author: Top.one

Article reference: Huma Finance PayfFi Ecosystem Map

First, the concept of PayFi was born

In April 2024, Lily Liu, Chairman of the Solana Foundation, first proposed the concept of "PayFi" at the Web3 Carnival in Hong Kong. Although this new term is new, it accurately hits a key pain point of blockchain finance:

After DeFi and RWA (real world assets), the on-chain world is still one core component away from truly realizing "daily-grade financial instruments" - payment financing.

The core of PayFi is not the payment itself, but the deep integration of payment and financial functions: through on-chain technology, the underlying financial logic such as credit, cash flow, and settlement is reconstructed, and stablecoins, contracts, identity, compliance, custody, and payment systems are packaged into an efficient and programmable financial network.

This narrative not only makes up for the lack of DeFi application scenarios, but also opens up the "capital circulation path" that is most in demand in the real world.

2. The six-layer PayFi ecological structure proposed by Huma Finance: reconstructing the on-chain financial engine

According to the PayFi Ecological Map recently released by Huma Finance, the PayFi Stack consists of six core modules, from the underlying protocol to the application scenarios, constituting a complete on-chain financial operating system:

1) Financing Layer: Turn income streams into assets

Core projects: Huma, Pyth, Chainlink, Credora, S&P Global

Feature Highlights:

Huma uses future cash flow as collateral to create an on-chain "Huabei"

Credora builds an on-chain credit rating system

Chainlink provides verification of asset authenticity

Pyth and S&P build on-chain price bridges with traditional marketplaces

2) Compliance Layer: The "financial firewall" on the chain

Core projects: Chainalysis, TRMLabs, Polyflow

Feature Highlights:

TRMLabs and Chainalysis provide on-chain risk control and anti-money laundering services

Emerging projects such as Polyflow explore a new paradigm of "compliance as code".

3) Custody Layer: Balance the security and flexibility of funds

Core projects: Fireblocks, Ledger, Phantom, Cobo, Squads

Feature Highlights:

Fireblocks, Ledger offer institutional-grade custody solutions

Phantom and Squads focus on the user-side custodial wallet experience

4) Currency Layer: Stablecoins are the main axis of the payment ecosystem

Stablecoin issuers: PayPal, Circle, Agora, Tether, Mountain, RD

Stablecoin infrastructure projects: Bridge, Paxos, Portal, Perena

5) Transaction Layer: High-performance chain supports real-time payment

Core infrastructure: Solana, Stellar and other high-throughput chains

Application scenarios: micropayment, cross-border large-value real-time settlement, etc

6) Application Layer: From payment cards to DePIN

Sub-areas and representative projects include:

Cross-border payments: Arf, Felix, Mural, Opera Mini, XOOM, Bitso, Coins.ph

Crypto payment cards: Rain, RedotPay, Reap, Visa, Kulipa, DCS

DePIN networks: Arkreen, DeCharge, DePHY, Roam

Payment infrastructure: Request Network, Coinflow Labs, Helio, Stripe, Mansa

Trade Finance: Jia, Trad.fi, ZOTH, Isle Finance, On.fund, BSOS

Foreign Exchange FX: SureFX, Shifts Markets

OTC OTC: Yellow Card, BANXA, Fonbnk, Hashkey, etc

3. PayFi is not an "on-chain payment", its potential is much more than that

1) RWA's liquidity engine

RWA enables assets to be on-chain, and PayFi brings these assets to life.

For example, invoice assets issued based on accounts receivable can be directly pledged in the PayFi system, such as borrowing, secondary transactions, or streaming payments, which significantly accelerates the flow of funds.

2) Accelerator of the on-chain credit system

PayFi projects generally combine on-chain identity and payment behavior data to build credit scoring models. In the future, an enterprise's payment cycle, salary flow, customer collection, etc., can be used as credit data input to provide customized financing services.

3) Finance is embedded in the key entrance to everything

From taxi-hailing, food delivery to logistics nodes, PayFi can realize embedded financial services of "payment as credit", and become the underlying financial facility in ecosystems such as DePIN and AI Agent.

4. Future outlook: Will PayFi become the next "national narrative"?

Compared with the high threshold of DeFi and the institutional attributes of RWA, PayFi has a truly applicable scenario for ordinary users:

Payroll loan and payroll card

Cross-border settlements and API payments

Payment incentives in the DePIN network

The long-tail financial needs of small and micro entrepreneurs and developing countries

In addition, PayFi is also a natural fit for today's compliance trends:

It establishes an auditable and risk-controlled payment financial system through on-chain, so that regulators can see the direction of funds, credit evolution and compliance data, and provide a landing path for "compliant on-chain finance".

It can be said that PayFi is gradually moving towards a new hub of composite narrative combining Stablecoin + RWA + Compliance.

5. Conclusion: From PayFi, look at the real landing path of the on-chain economy

We are in the midst of a structural "decentralized reorganization", and PayFi is one of the most fundamental and critical pieces of the puzzle:

It marks the evolution of on-chain finance from "capital market" to "daily finance";

It is a key inflection point for Web3 from "coin speculation" to "real-life scenarios";

It is the financial foundation that should not be ignored in the construction of an on-chain economy.

Mastering PayFi is to understand the core direction of the Web3 financial ecosystem in the next decade.

Show original33.8K

0

Pyth Network price performance in USD

The current price of Pyth Network is $0.096100. Over the last 24 hours, Pyth Network has increased by +3.33%. It currently has a circulating supply of 5,749,986,206 PYTH and a maximum supply of 10,000,000,000 PYTH, giving it a fully diluted market cap of $555.45M. At present, Pyth Network holds the 0 position in market cap rankings. The Pyth Network/USD price is updated in real-time.

Today

+$0.0031000

+3.33%

7 days

-$0.00550

-5.42%

30 days

-$0.03520

-26.81%

3 months

-$0.07370

-43.41%

Popular Pyth Network conversions

Last updated: 25/06/2025, 05:03

| 1 PYTH to USD | $0.096600 |

| 1 PYTH to PHP | ₱5.4917 |

| 1 PYTH to EUR | €0.083107 |

| 1 PYTH to IDR | Rp 1,574.06 |

| 1 PYTH to GBP | £0.070865 |

| 1 PYTH to CAD | $0.13257 |

| 1 PYTH to AED | AED 0.35475 |

| 1 PYTH to VND | ₫2,527.47 |

About Pyth Network (PYTH)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Pyth Network FAQ

How much is 1 Pyth Network worth today?

Currently, one Pyth Network is worth $0.096100. For answers and insight into Pyth Network's price action, you're in the right place. Explore the latest Pyth Network charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Pyth Network, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Pyth Network have been created as well.

Will the price of Pyth Network go up today?

Check out our Pyth Network price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.