DAI

DAI price

$1.0000

-$0.00010

(-0.01%)

Price change for the last 24 hours

DAI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$3.65B

Circulating supply

3,653,088,033 DAI

100.00% of

3,653,088,033 DAI

Market cap ranking

13

Audits

Last audit: 1 May 2021, (UTC+8)

24h high

$1.0006

24h low

$0.99560

All-time high

$8,976.00

-99.99% (-$8,975.00)

Last updated: 2 Aug 2019, (UTC+8)

All-time low

$0.0011000

+90,809.09% (+$0.99890)

Last updated: 2 Aug 2019, (UTC+8)

How are you feeling about DAI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DAI Feed

The following content is sourced from .

乔帮主退休月球收租و 🔆

🍿Hello Spark @sparkdotfi family!

This is the @cookiedotfun of the Countdown Chapter

This journey is coming to an end, so please check your ranking again, make sure your wallet is bound correctly, and make the final preparations.

Along the way, we are walking side by side with Spark, delving into DeFi and sharing our hopes for the future. Project analysis, airdrop strategies, and information follow-up have recorded our sweat and persistence. Maybe I don't have many points and the ranking doesn't meet my expectations, but every bit of growth makes me happy, and I am even happier to meet the best of you

Spark is more like a capital scheduling hub in the DeFi world.

It allows stablecoins such as DAI and USDC to efficiently flow to the corners of the market with the strongest market demand.

From partnering with @pendle_fi to launch time-weighted yields to introducing 200 million DAI liquidity through the Maker D3M module, Spark is building an ecosystem that spans lending, derivatives, and RWA.

In a short period of time, Spark's TVL has been firmly at the forefront of DeFi.

It has nearly tripled from the low point at the beginning of the year, with more than 177,000 ecological users and a 24-hour trading volume of $182 million $SPK.

The DeFi arena is huge, but Spark connects us hand-in-hand. Although Twitter is small, the enthusiasm of the friends is never absent! I hope that when we talk about Spark again in the future, it has become a DeFi benchmark with a market value of more than 1 billion and a TVL of more than 10 billion.

In this journey, I hope that everyone will not only gain wealth and knowledge, but also gain trust and friendship with each other.

Goodbye, hello

Ignite the next spark 💥 in Spark

Show original

2.45K

0

常为希 |加密保安🔸🚢🇺🇸

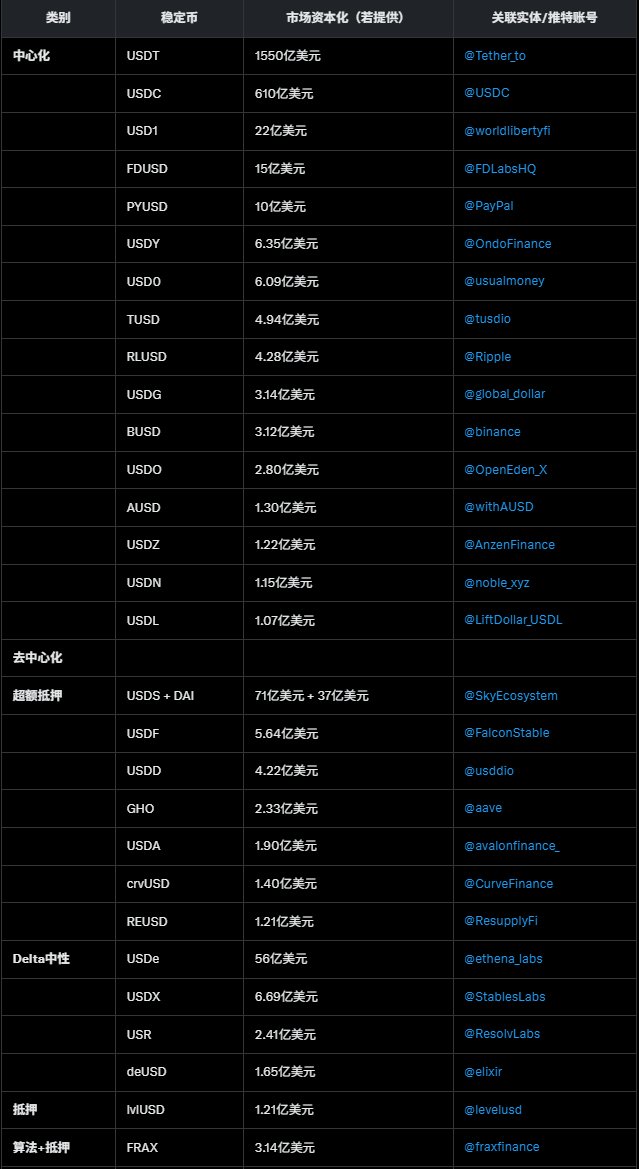

The market capitalization (MC) of stablecoins exceeding $100 million is categorized into centralized and decentralized types, with the decentralized category further divided into over-collateralized, delta-neutral, collateralized, and algorithmic + collateralized categories.

The total market capitalization of centralized stablecoins is significantly higher than that of decentralized ones.

USDT ($155 billion) and USDC ($61 billion) dominate, collectively controlling a large portion of the centralized stablecoin market (about 85%).

Other centralized stablecoins (such as USD1, FDUSD, PYUSD, etc.) have market capitalizations ranging from $100 million to $2.2 billion, indicating that small to medium-sized projects are also attempting to enter the market. PayPal's PYUSD ($1 billion) shows that traditional financial giants are starting to venture into the stablecoin space.

Over-collateralized: Represented by USDS + DAI ($7.1 billion + $3.7 billion), this category relies on over-collateralized crypto assets (such as ETH) to maintain stability, with a relatively balanced market capitalization distribution.

Delta-neutral: USDe ($5.6 billion) leads, with this mechanism achieving price stability through hedging strategies (such as perpetual futures), offering high capital efficiency.

The total market capitalization of centralized stablecoins far exceeds that of decentralized ones, reflecting the current market's preference for stable solutions backed by institutions.

The diversified mechanisms of decentralized stablecoins, such as delta-neutral and algorithmic stability, demonstrate the potential for technological innovation.

26.44K

5

Convert USD to DAI

DAI price performance in USD

The current price of DAI is $1.0000. Over the last 24 hours, DAI has decreased by -0.01%. It currently has a circulating supply of 3,653,088,033 DAI and a maximum supply of 3,653,088,033 DAI, giving it a fully diluted market cap of $3.65B. At present, DAI holds the 13 position in market cap rankings. The DAI/USD price is updated in real-time.

Today

-$0.00010

-0.01%

7 days

+$0.000100000

+0.01%

30 days

+$0.00020000

+0.02%

3 months

+$0.00020000

+0.02%

Popular DAI conversions

Last updated: 24/06/2025, 19:39

| 1 DAI to USD | $0.99950 |

| 1 DAI to PHP | ₱56.9345 |

| 1 DAI to EUR | €0.86094 |

| 1 DAI to IDR | Rp 16,305.06 |

| 1 DAI to GBP | £0.73440 |

| 1 DAI to CAD | $1.3706 |

| 1 DAI to AED | AED 3.6706 |

| 1 DAI to VND | ₫26,151.23 |

About DAI (DAI)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Learn more about DAI (DAI)

Ai Meme Daily: Key Trends and Insights Shaping the Memecoin Market

Introduction to Ai Meme Daily The cryptocurrency market is no stranger to innovation, and the rise of memecoins has added a unique layer of cultural and financial dynamics. Ai Meme Daily, a collaborative initiative by PANews and GMGN.AI, provides a comprehensive snapshot of the memecoin market, offering investors timely insights into trends, token performance, and market sentiment. This article delves into the latest updates, key developments, and actionable insights from Ai Meme Daily to help crypto investors navigate this volatile yet promising space.

18 Jun 2025|OKX

What is DAI: understanding Maker's crypto-backed stablecoin

Launched by a Decentralized Autonomous Organization (DAO) named MakerDAO in November 2019, Dai (DAI) is a crypto-collateralized stablecoin that's soft-pegged to the US Dollar at a 1:1 ratio. DAI is issued through an Ethereum-based named the Maker Protocol.

21 May 2024|OKX|

Beginners

DAI FAQ

How much is 1 DAI worth today?

Currently, one DAI is worth $1.0000. For answers and insight into DAI's price action, you're in the right place. Explore the latest DAI charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as DAI, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as DAI have been created as well.

Will the price of DAI go up today?

Check out our DAI price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to DAI

Socials