Original title: "In addition to BTC and ETH, what is the best crypto investment target in 3-5 years in the eyes of these bigwigs?" 》

Original source: TechFlow

"If you had to buy liquid/non-risky cryptocurrencies in a 3-5 year timeframe and were not allowed to buy BTC, ETH, HYPE, SOL or hold stablecoins, what would you buy? Why?"

On June 22, the well-known crypto KOL @Cobie raised the above question on X.

Crypto KOLs, traders, and VC investors have given their "wealth passwords" in the comment area.

We've taken a look at the opinions and choices of some of the biggest names in the industry to see if there's anything you're interested in.

Head of Base jesse.base.eth: Coinbase ($COIN)

Bullish on $COIN (Coinbase) because: (1) it has an incredibly diverse and robust product line that has formed a scaled user base and market-leading brands; (2) It is one of the most executing and visionary on-chain teams in this space, and perhaps even the strongest.

Crypto KOL Ansem: Worldcoin ($WLD)

Hedge OpenAI/Altman's risk in winning the AI race and monitor countries. In the post-AGI era, we need a verifiable way to distinguish between who is human and who is AI. If OpenAI were going to do something with their vast database of individuals in the future, it would most likely have something to do with decentralized identity (WLD).

AllianceDAO Founder qw: A token with strong revenue

In the 3-5 year timeframe, the only correct answer is a token with strong (future) revenue that is currently trading at a reasonable multiple.

Everything else will go to zero. Monetary premiums other than Bitcoin are a thing of the past.

Crypto trader Auri: Starknet ($STRK)

If you think decentralization and privacy are important, follow Starknet

Current Status:

- As an Ethereum L2, it can compete with Solana in terms of TPS (transactions per second).

- Deliver a top-tier user experience with unique AA (Account Abstraction) features and on-chain performance

- Relatively low valuation (fully diluted valuation of $1 billion vs. $3 billion for Arbitrum/Optimism)

There are three paths to success:

- Become a generic layer

- Bitcoin L2 (if settlement on Bitcoin becomes feasible and efficient), this alone I think could multiply Starknet's valuation several times

- If all other paths fail, it can be used as backend infrastructure for other on-chain applications

Mert, founder of Helius Labs: Jito ($JTO), Zcash ($ZEC)

JTO—If you believe that SOL will be around in the next 3-5 years (and it is), then that's pretty self-explanatory

Zcash — I think the privacy coin is coming back, and the chain is about to be redesigned under the new lab body, which is impressive from a technical standpoint

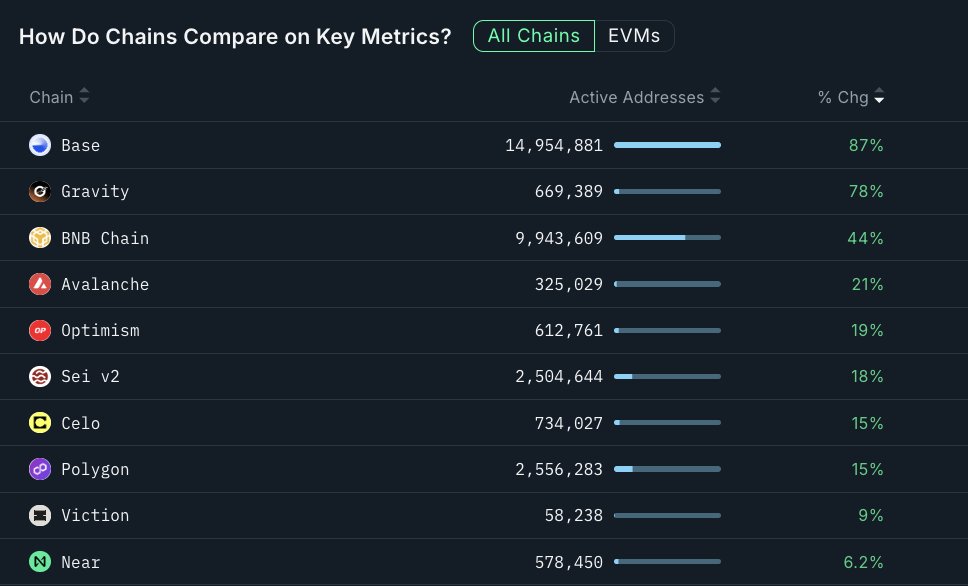

Alex Svanevik, founder of Nansen: Building L1 portfolios

Build a diverse portfolio of Layer 1 (L1) blockchain assets to achieve long-term investment returns. There are already BTC, ETH, HYPE, SOL, and new BNB, SUI, APT, TRX, AVAX, a total of 9 assets, covering mainstream and potential public chains, and staking all assets to obtain about 4.5% annualized return.

Crypto KOL Fishy Catfish: Chainlink ($Link)

Chainlink has maintained its top dominance in terms of market share and security for 6 years (even higher than in 2021)

Real-world asset (RWA) tokenization and stablecoins are two of the largest marketplaces for utility use cases, and Chainlink provides a complete platform for data, connectivity, and computing services in both areas.

Chainlink has been years ahead of its competitors in serving TradFi demand:

A. Coming soon to an automated compliance engine (ACE): Proof of Identity, Proof of Onboarding, Accredited Investor Verification and Sanctions Checks

B. Coming soon to CCID: Cross-Chain Identity System

C. Chainlink has a complete privacy suite (CCIP Private Transactions, Blockchain Privacy Manager, DECO (patented zkTLS))

In addition, it is well ahead of other competitors (including SWIFT, DTCC, JPMorgan Chase, ANZ, UBS, etc.) in terms of traditional finance adoption

Blockchain capture is decreasing, while Chainlink and applications are increasing. For example, the liquidation arbitrage MEV generated by oracle updates, which was previously owned by blockchain validators, is now shared by Chainlink and Aave.

Crypto KOL Murad: $SPX

Why: SPX, as the first "Movement Coin", aims to disrupt the entire stock market. The impact of SPX on GME is comparable to that of BTC on gold, if not worse. It's arguably the most passionate community on crypto Twitter, and it's still in its early stages. It is the only "meme" coin with a real mission. It's the perfect meme vehicle to represent a cultural pushback to the millennial dilemmas and challenges faced by Gen Z around the world. It merges finance with the spiritual world and targets a larger potential market than any other crypto asset ever before. As millions of people begin to lose their jobs and meanings, many will seek tokenized digital shelters, which are one of the strongest rising forces.

APG Capital Trader Awawat: $BNB, $LEO, $AAVE, $MKR, $XMR

Considering this time span, only a few options make sense:

· PAXG/XAUT (Gold Token), it's easy to see why

· BNB/LEO, the upside is limited but the downside risk is also small

· AAVE/MKR: It should be here to stay

· XMR (Monero)

Many of the responses are pitching their portfolios, but objectively speaking, those coins will go to zero over this time horizon

Crypto KOL W3Q: $HOOD, $TSLA

In 5 years, with the exception of Bitcoin, the pure cryptocurrency space will not consider holding.

$HOOD (Robinhood) - Shovels and pickaxes (infrastructure) in retail finance

From betting to mortgages to scaling crypto products, they're moving into all the money-making verticals and have a better user experience and distribution channels than most.

$TSLA (Tesla) - The field of AI robotics covers both software and hardware. Musk may be interested in cryptocurrencies again in the next hype cycle.

If not subject to self-custody, it will be selected

Bitcoin ETF with 2x leverage

Use a portion of your portfolio layout at market cycle lows or extreme sell-offs.

Vance Spencer, Partner, Framework Ventures: $SKY

$SKY, it's important to note that it's not currently on any CEXs.

Arthur, founder of DeFiance Capital: $AAVE, $ENA, $PENDLE, $JUP

The above are their investment choices, so what do you see as a long-term investment target for 3-5 years?

Link to original article

Show original

Socials