Keep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

In this edition, we share the latest crypto derivatives weekly from Block Scholes.

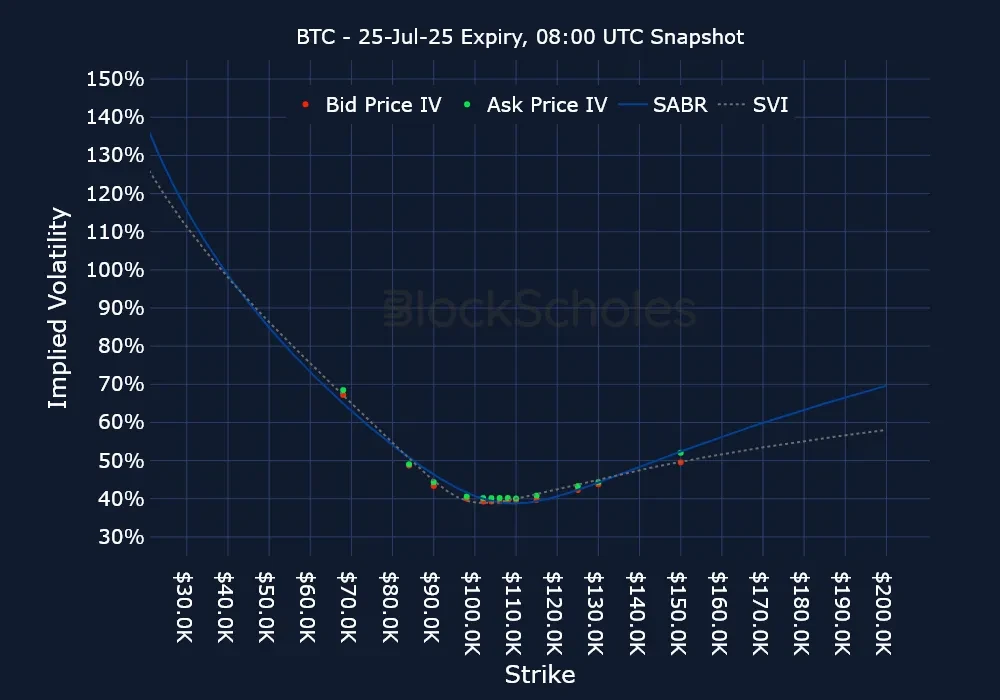

The past three days has seen the US militarily join Israel in its conflict against Iran, bombing three key Iranian nuclear sites. That sent BTC below $100K for the first time since early-May, flattening its term structure of volatility as front-end volatility jumped to 45%. ETH spot price fell to its lowest intraday level since May 9, and short-tenor options led the move in implied volatility, resulting in a term structure inversion which has yet to be resolved fully. Iran retaliated yesterday afternoon which initially sent markets lower once more – though it was later revealed to be a de-escalatory reaction with advance notice to Washington. That then sent markets soaring, a rally extended further by President Trump announcing an official ceasefire between Iran and Israel. BTC now currently trades at $105K.

ATM Implied Volatility, 1-Month Tenor

BTC Options

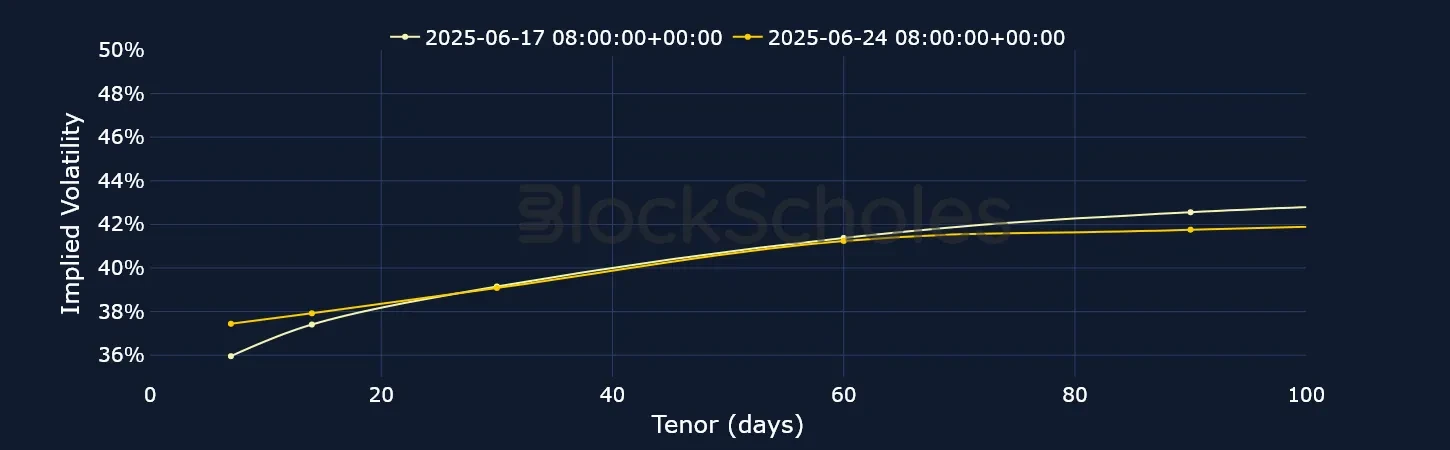

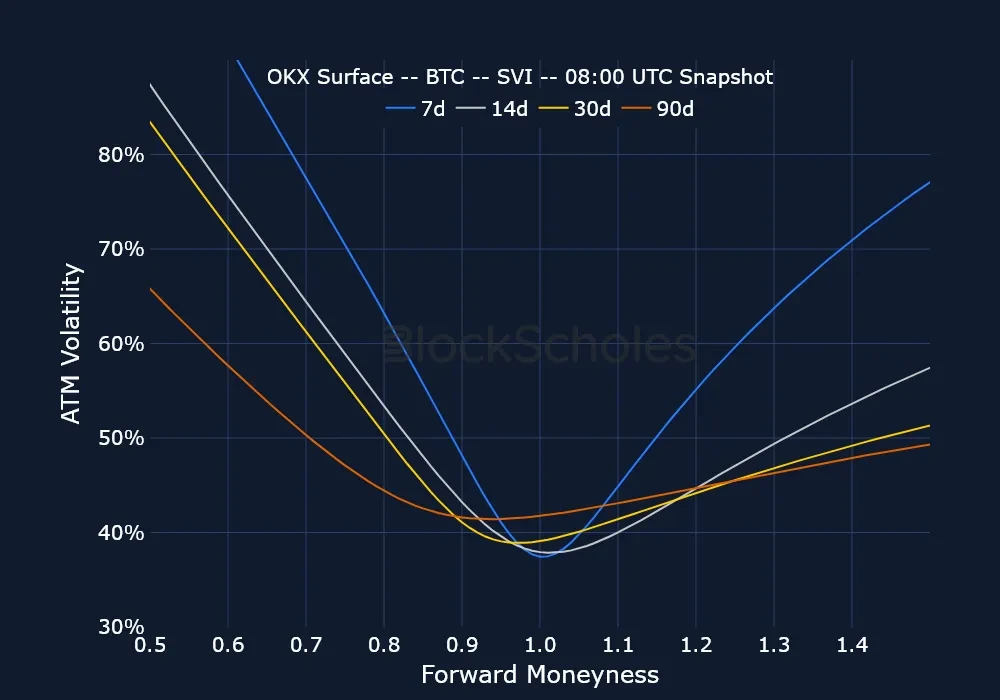

BTC SVI ATM Implied Volatility

After a brief flattening of the term structure yesterday, the volatility curve is once more upward sloping.

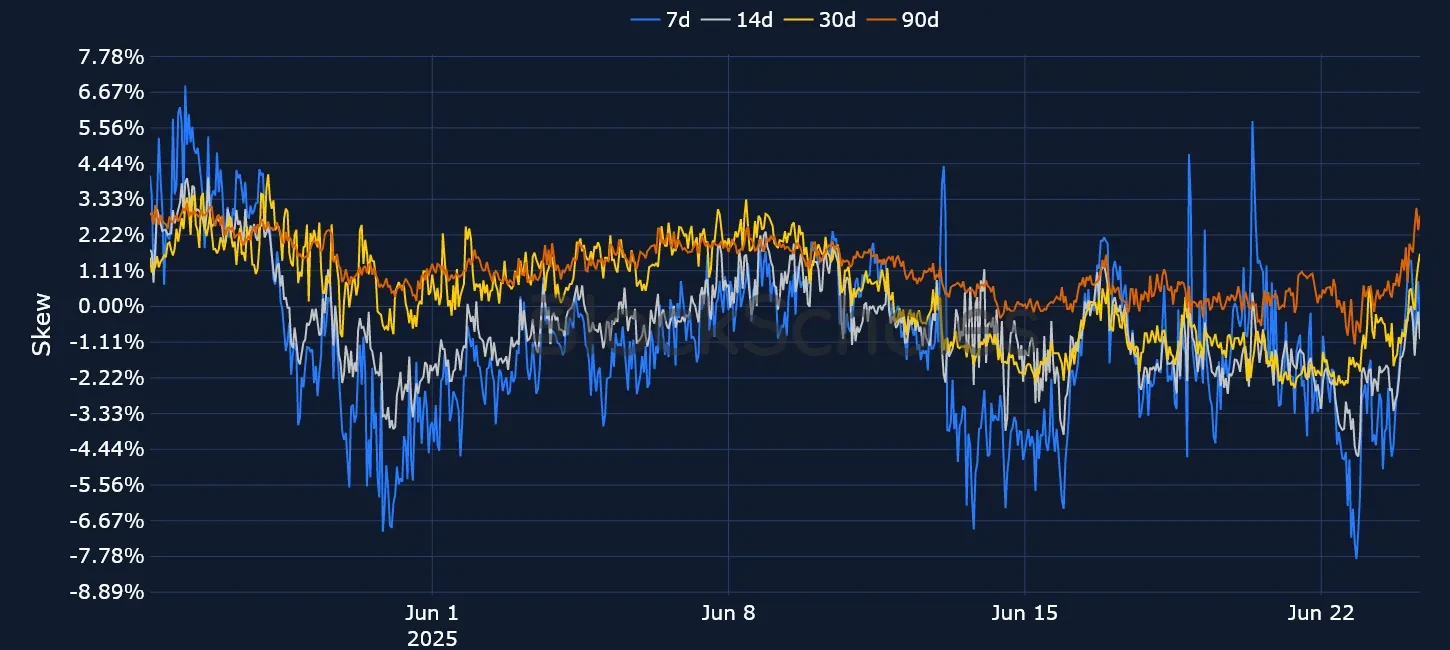

BTC 25-Delta Risk Reversal

BTC’s skew briefly traded positive, in favour of OTM calls, before reversing direction after spot slips

ETH Options

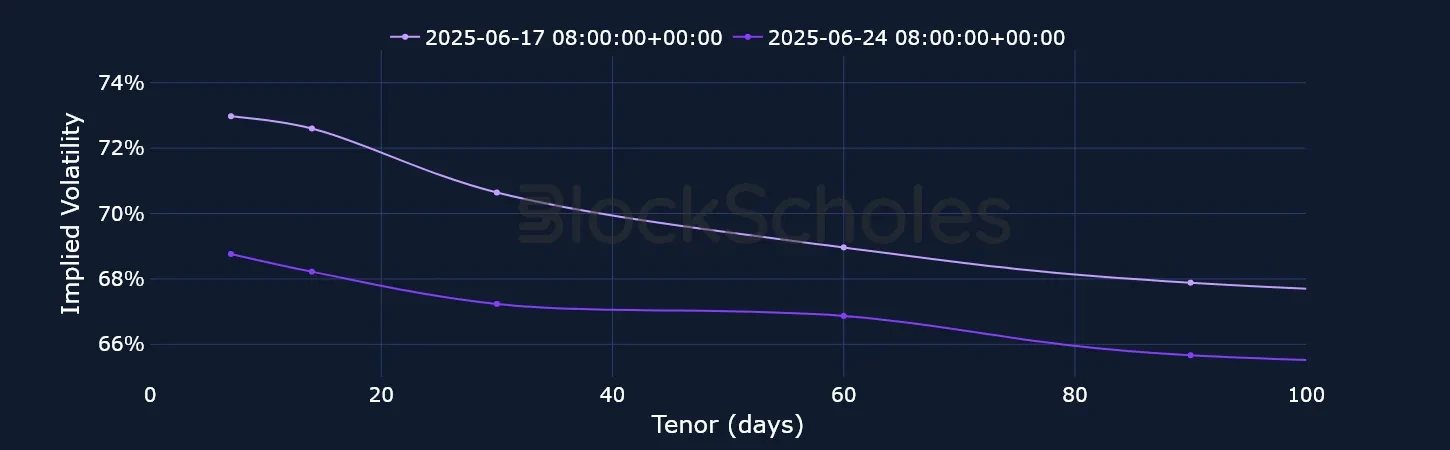

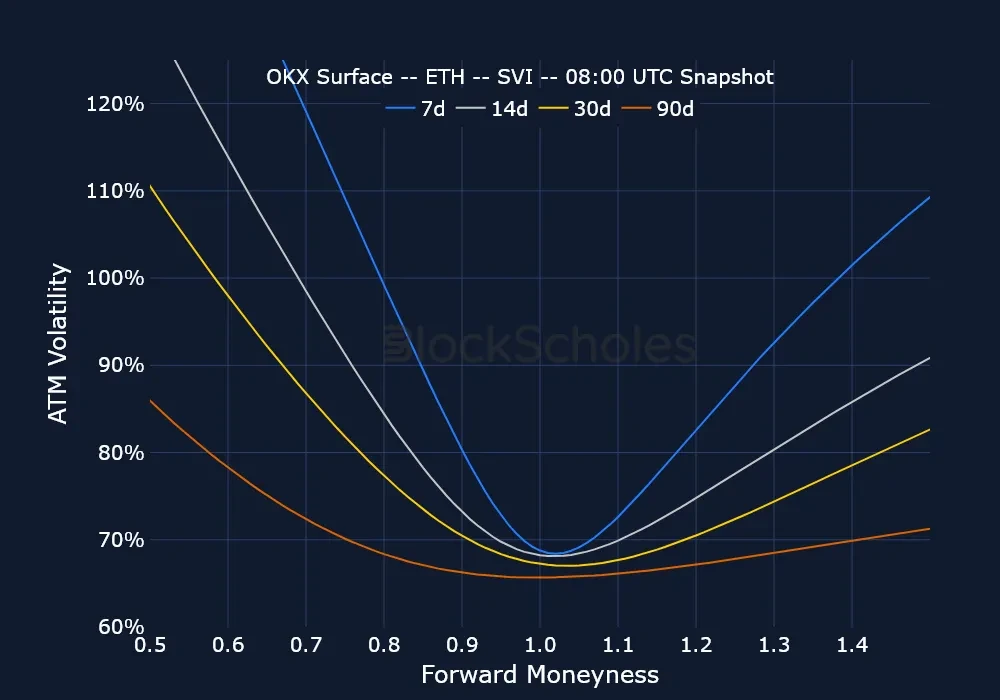

ETH SVI ATM Implied Volatility

ETH’s term structure still contrasts that of BTC – inverted, though at lower outright levels than last week.

ETH 25-Delta Risk Reversal

ETH short-tenor smiles skewed as much as 15% towards OTM puts when Trump announced US strikes on three key Iranian nuclear sites – though that has now abated to a 3% skew towards OTM puts.

Market Composite Volatility Surface

Listed Expiry Volatility Smiles

Constant Maturity Volatility Smiles

The information provided in this document by Block Scholes Ltd is for informational purposes only and does not necessarily represent the views of OKX. Any additional disclaimers issued by these third parties are also applicable and should be considered as part of this document.

This report is not intended as financial advice, investment recommendation, or an endorsement of specific trading strategies. The contents of this report, including but not limited to any graphs, charts, and numerical data, are provided “as is” without warranty of any kind, express or implied. The warranties disclaimed include but are not limited to performance, merchantability, fitness for a particular purpose, accuracy, omissions, completeness, currentness, and delays.

The cryptocurrency markets are highly volatile and unpredictable, subject to substantial market risks including significant price fluctuations. The strategies, opinions, and analyses included are based on information available at the time of writing and may change without notice. They are also based on certain assumptions and historical data that may not be accurate or applicable in the future. Therefore, reliance on this report for the purpose of making investment decisions is at your own risk.

Past performance is not indicative of future results. While we strive to provide accurate and timely information, we cannot guarantee the accuracy or completeness of any data or information contained in this report. We are not responsible for any losses or damages arising from the use of this report, including but not limited to, lost profits or investment losses.

Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The inclusion of any specific cryptocurrencies or trading strategies does not constitute an endorsement or recommendation by OKX.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” Some content may be generated or assisted by artificial intelligence (AI) tools. No derivative works or other uses of this article are permitted.