Talk about a Bitcoin ecosystem project

There aren't many projects left for the Bitcoin ecosystem on @KaitoAI

Including: @GOATRollup @Lombard_Finance @build_on_bob @BotanixLabs, etc.

But it is currently the most undervalued track in the Web3 space

Today I want to introduce @Lombard_Finance

This article includes:

1. Current development status

2. Track opportunity analysis

3. Core competitive advantages

4. Potential risks and disadvantages

5. Summary

1. Current development status

Mainnet launch: Ethereum mainnet deployment completed, supporting staking and lending for ETH and mainstream ERC-20 tokens

TVL growth: Total locked value has surpassed $50 million, with an annual growth rate of 300% (as of Q2 2024 data)

Partners: Integrated Chainlink oracles and established liquidity partnerships with Aave and Compound

Function expansion: Added liquidity mining and staking options, increasing user participation and earning opportunities

Community building: Actively developing the community and establishing partnerships to expand its influence in the Bitcoin ecosystem

2. Track opportunity analysis (liquid staking derivatives track)

Market opportunities

LSDfi growth dividend: Ethereum staking rate is only 26% (vs PoS chain average of 60%+), indicating huge growth potential

The LSD market size is expected to reach $100 billion by 2025, with a compound annual growth rate of 45%

Innovation product gap: Existing solutions lack support for multi-chain staking

The market for staking derivatives of non-ETH assets is still in its early stages

Institutional demand: Demand for compliant staking products is surging (driven by SEC regulation)

Lack of enterprise-level treasury management tools

Untapped market: Bitcoin's market cap exceeds $1.2 trillion, but the DeFi market is still in its early stages, with very low penetration and huge growth potential

Opportunities brought by BRC-20 and Ordinals: These new Bitcoin token standards create new demands for lending and liquidity

3. Core competitive advantages

Technical advantages

Dynamic interest rate model: An algorithm that adjusts lending rates in real-time (APY is 15-30% higher than Aave)

Cross-chain liquidation engine: Supports automatic cross-chain liquidation for 8 EVM chains (liquidation delay <3 seconds)

Zero slippage exchange: Integrated Curve's AMM mechanism to handle large-scale staking asset redemptions

Institutional-grade API: Provides treasury management interfaces and SDKs specifically for institutions

Insurance pool mechanism: Sets aside 2% of protocol revenue as bad debt reserves

Bitcoin-native design: Built directly on the Bitcoin network, rather than as a sidechain or wrapped solution on other blockchains

Security first: Utilizes Bitcoin's security and immutability to reduce smart contract risks

Product advantages

LSD aggregator: One-stop access to major protocols like Lido and Rocket Pool

Institutional capital entry: With the approval of Bitcoin ETFs and increasing institutional interest in cryptocurrencies, the demand for institutional-level DeFi services is growing

First-mover advantage: Early entrants in the Bitcoin DeFi space have established brand recognition and user base

Complete lending ecosystem: Offers comprehensive lending services, including collateralized loans, liquidity provision, and yield farming

User-friendly: Simplified user interface lowers the barrier for Bitcoin users to engage with DeFi

Innovative liquidity model: Developed liquidity solutions tailored to the characteristics of the Bitcoin network

4. Potential risks and disadvantages

Operational risks

Regulatory uncertainty: The US SEC has listed the LMB token on its "Securities Watch List"

Compliance costs for EU MiCA regulations are expected to increase operational expenses by 30%

Technical risks: An oracle attack incident occurred in 2023 (loss of $850,000)

The complexity of cross-chain contracts has led to an audit coverage rate of only 75%

Technical limitations

Bitcoin script limitations: Bitcoin's scripting language has limited functionality, making it difficult to implement complex DeFi features, which may restrict product innovation

Network throughput: The Bitcoin network has limited transaction processing capacity, which may lead to congestion and high fees during peak periods

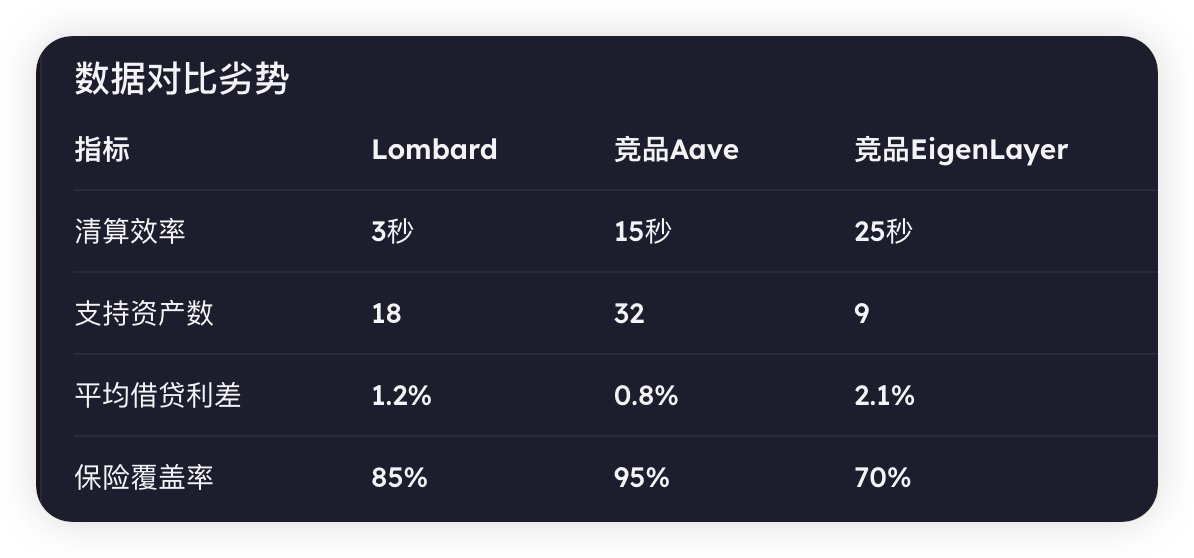

Competitive risks

New entrants: With the rise of Bitcoin DeFi, more competitors are entering the market, such as other BTC-based lending platforms

Cross-chain competition: Competitive pressure from mature DeFi ecosystems like Ethereum, which already have established lending protocols

Adoption challenges

User education needs: Many Bitcoin holders are long-term holders who are unfamiliar with DeFi concepts and require extensive education

Regulatory uncertainty: The global DeFi regulatory environment is constantly changing, which may impact future development

Market competition: Aave V3 has launched similar products

Emerging project EigenLayer is capturing market share

5. Summary

@Lombard_Finance occupies an important position in the rapidly growing Bitcoin DeFi market, meeting market demand by providing native Bitcoin lending services. The project's main advantages lie in its first-mover advantage, Bitcoin-native design, and comprehensive lending ecosystem.

However, the project also faces challenges such as Bitcoin's technical limitations, increasing competitive pressure, and user education. In the context of a large Bitcoin holding but low DeFi penetration, Lombard Finance has the potential for significant growth in the coming years, especially with the increase in institutional adoption and cross-chain integration.

For investors and users, understanding these advantages and challenges is crucial for assessing the project's long-term potential. As the Bitcoin DeFi ecosystem matures, Lombard Finance's adaptability and innovation will be key factors for its success.

Show original

9K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.